AMEX HK offers charge cards and credit cards. The term "credit card" in this article refers to the collective term for these two types of cards.

AMEX HK used to have a time of generous credit card approvals, where mainland residents only needed a passport and a Hong Kong address to apply for an AMEX HK credit card. However, those good times are gone, and now you need a Hong Kong credit history (TransUnion HK) to apply for an AMEX HK credit card, although the approval process is still relatively easy.

The author of this article also debunked several misconceptions about applying for an AMEX HK card:

-

Do you need at least 3/6 months of Hong Kong credit history to apply for AMEX HK?

The author of this article applied for an AMEX HK card after having their first Hong Kong credit card approved for a little over a month (a complete credit card statement). However, some banks may not report to TransUnion on the first statement.

-

Can only a Mainland Travel Permit for Hong Kong and Macau Residents / passport / HKID be reported to TransUnion?

The author's first Hong Kong credit card was approved by CNCBI, which only allows Mainland residents to register their CNID (Chinese Resident Identity Card) as the primary identification document. Other documents such as passports and travel permits can only be used as secondary identification documents. The author did not provide a passport or travel permit to the bank when applying for CNCBI, as they applied for it early on.

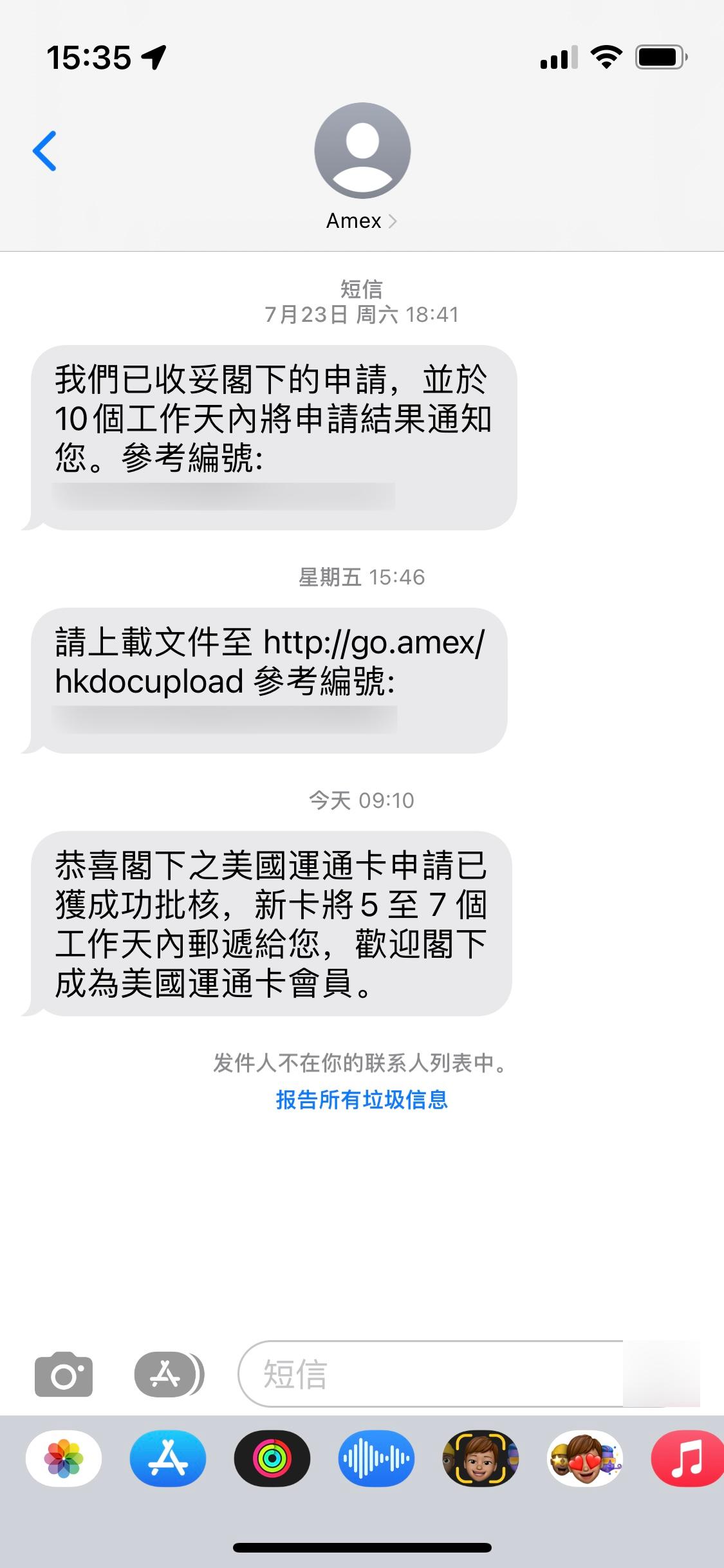

After 11 days (8 working days), the author finally received approval for the AMEX HK credit card.

After using a China CITIC Bank credit card for a month, the author followed the trend and applied for an AMEX HK card. Since all AMEX HK cards have Foreign Transaction Fees (FTF), they are not suitable for use outside of Hong Kong and Macau. Additionally, AMEX's charge cards (small head) and credit cards (big head) often have more local merchant discounts, making them relatively less useful for overseas use compared to AMEX US. Therefore, the author applied for the fee-free basic card (Essential Credit Card).

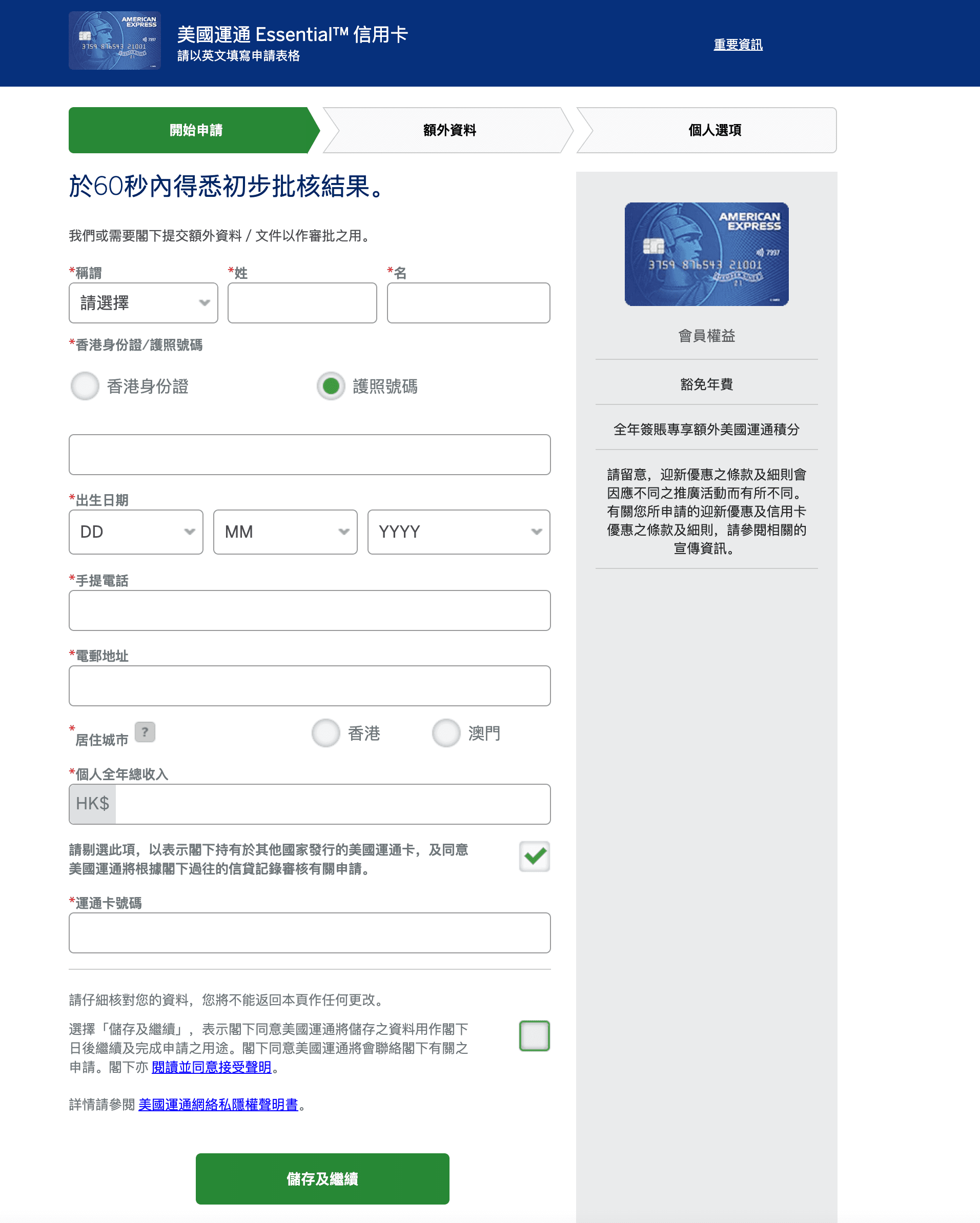

When filling out the application, if you already have a card directly issued by American Express in another country, you can enter the card number to increase the chances of approval and also inherit the "Member Since" from the other country's card. However, this is not strictly a Global Transfer (GT), and applying from here still requires a Hong Kong credit history to be approved. It is said that you can request a paper application form specifically for GT from customer service, which does not require a Hong Kong credit history, but this is beyond the scope of this article.

It may be because I filled in the card number of another country's AMEX card during the application, or it may be because my credit situation was not good enough, but I did not receive an immediate pre-approval after submitting the application form. Meanwhile, a friend who applied at the same time without filling in the card number of another country's AMEX card immediately received a pre-approval.

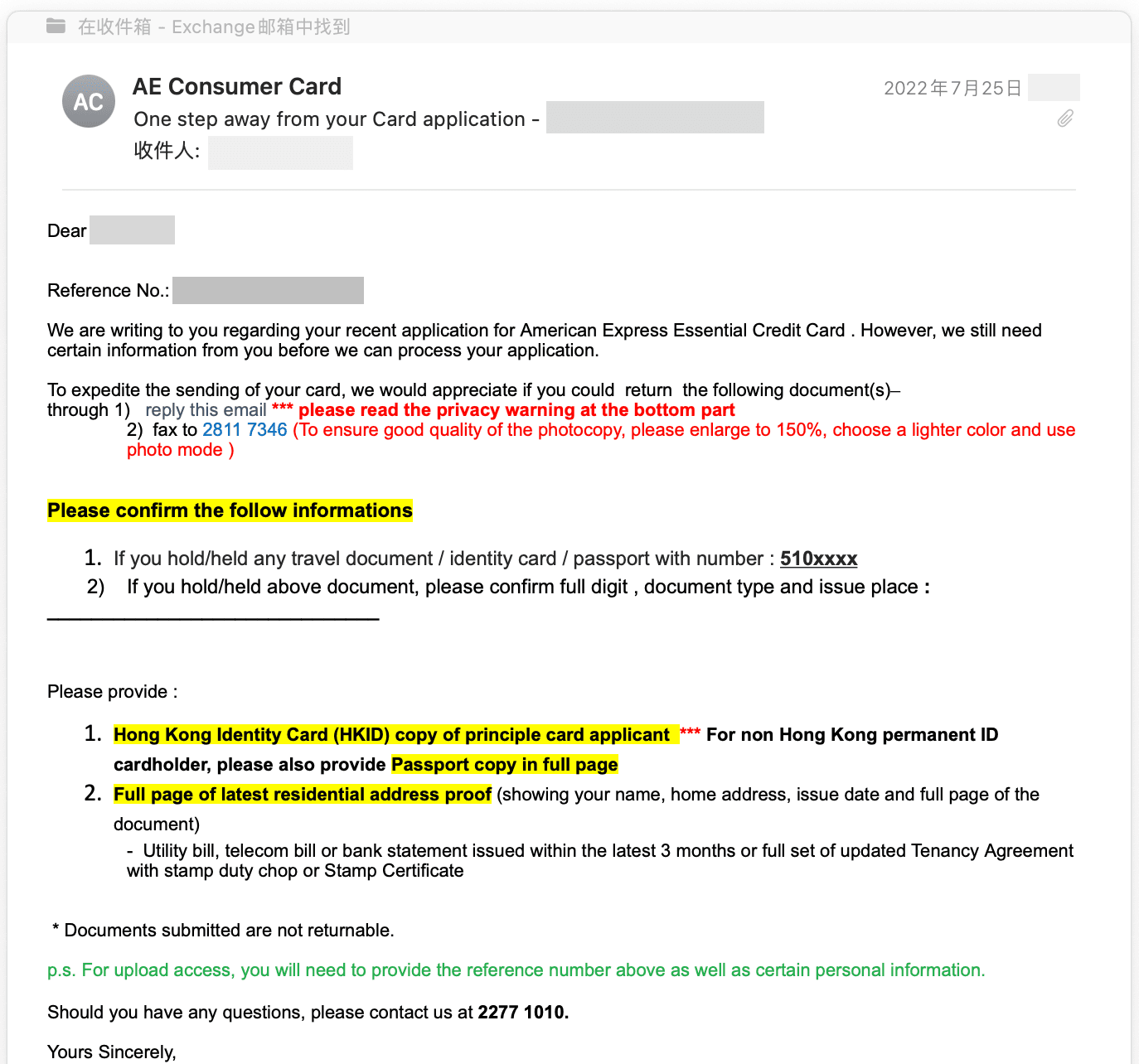

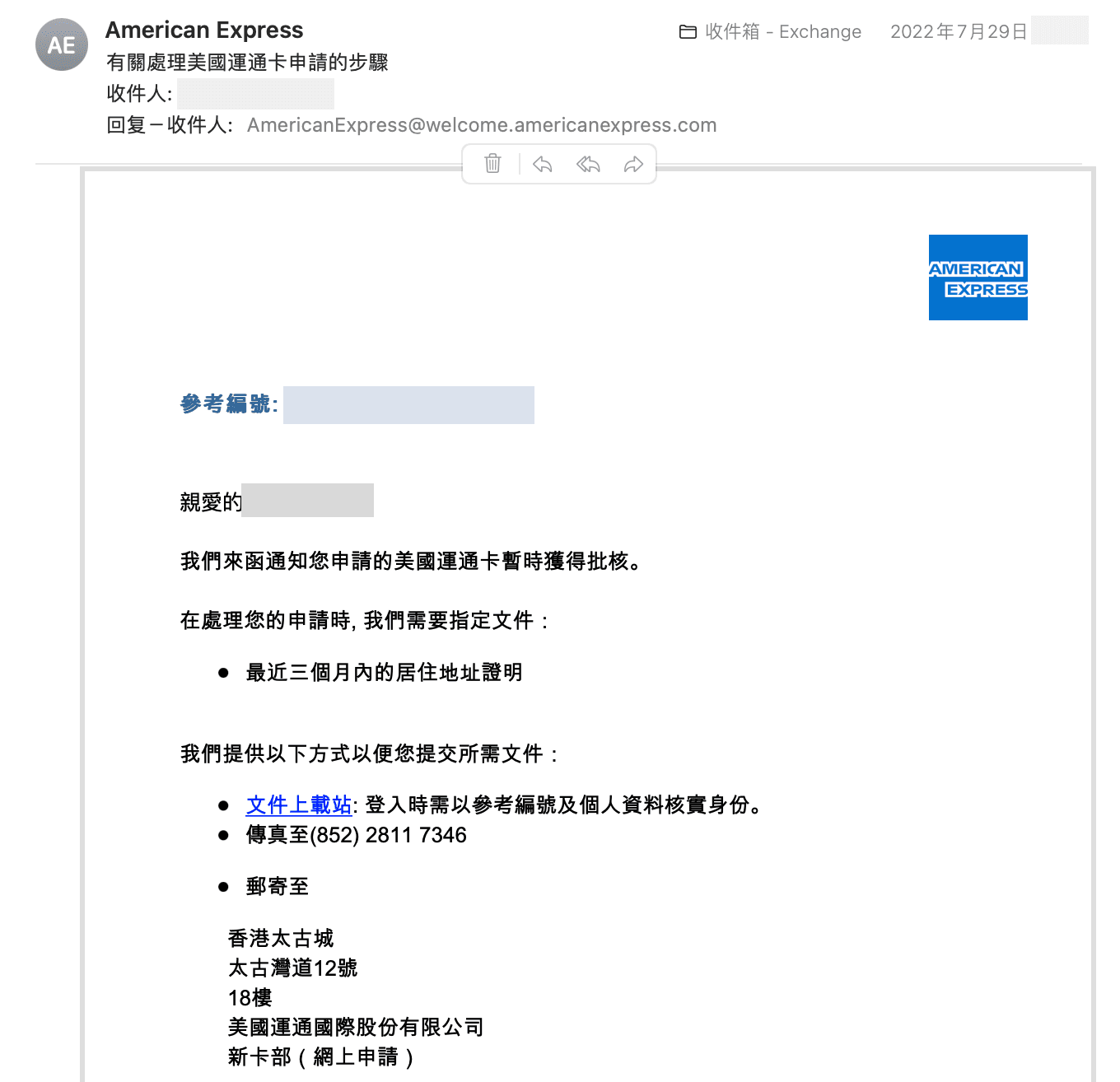

On the first working day after submitting the application, an AMEX HK customer service representative called to process the application. However, I missed the call because my phone was on silent mode. Fortunately, the customer service representative later sent the relevant information via email.

In the email, it can be seen that AMEX first asked if the ID number starting with 510 was mine and what type of document it was. This is exactly the CNID I used to apply for the China CITIC Bank credit card. Therefore, it can be seen that CNID can also be reported to TransUnion, and China CITIC Bank reports to TransUnion on the first statement.

After providing the requested information to AMEX HK, it took about 5 working days for the customer service representative to call again and inform me that the CMHK Statement I used as proof of address was not sufficient, and they suggested providing bank statements or utility bills/lease agreements. I informed the customer service representative that it would take a few more days to have a bank statement with a Hong Kong address, and the representative said they would put my application on hold until I submit the proof of address.

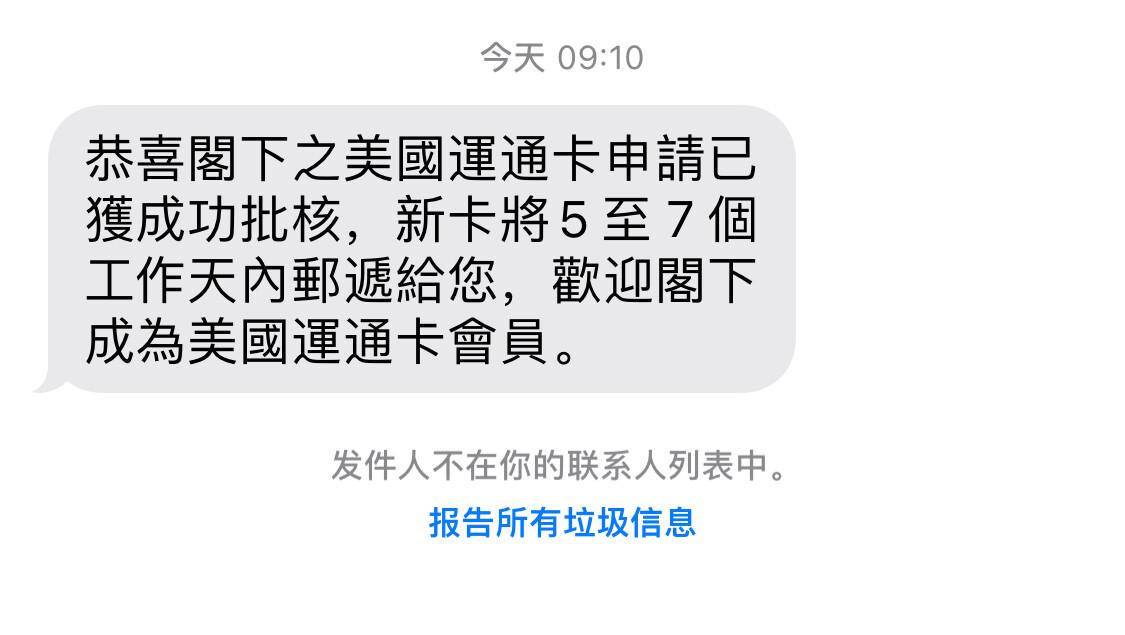

Finally, on the night of August 2nd, the new statement from China CITIC Bank was issued, and after receiving the email notification, I immediately submitted the proof of address. By 9 a.m. on August 3rd, I received an SMS notification that my credit card application had been approved.

You can call AMEX HK to inquire about the approved credit limit, but I'm too lazy to bother since I don't expect it to be very high. I'll just go with the flow.