If not otherwise specified, "China" in any page, image and URL link on this site refers to mainland China (excluding Hong Kong SAR, Macau SAR and Taiwan region)

The term "Chinese resident" in this article refers to a person who has only Chinese nationality, lives in mainland China, and does not have permanent resident status in Hong Kong SAR, Macau SAR or Taiwan resident status.

Basic Requirements#

To apply for a credit card from CITIC Bank International (hereinafter referred to as CITIC International), you must first have a bank account with CITIC International. Currently, you can still witness the account opening in mainland China through CITIC Securities' channels. If you can't handle this channel, you can also spend some money to let an intermediary handle it for you.

Updated on Jun 20th, 2022: According to the test results of some group members, even the disabled inMotion account (most functions, including fast FPS transfer, cannot be used) opened directly on the App before can also successfully apply for a credit card.

In addition, if you choose to continue reading this article, I guess you don't have an HKID and Hong Kong proof of address, so you need to deposit at least 50K HKD equivalent assets in your CITIC International account to apply for a credit card. Theoretically, the more you deposit, the higher the credit limit for card approval.

Card Showcase#

Application Form#

Card Types#

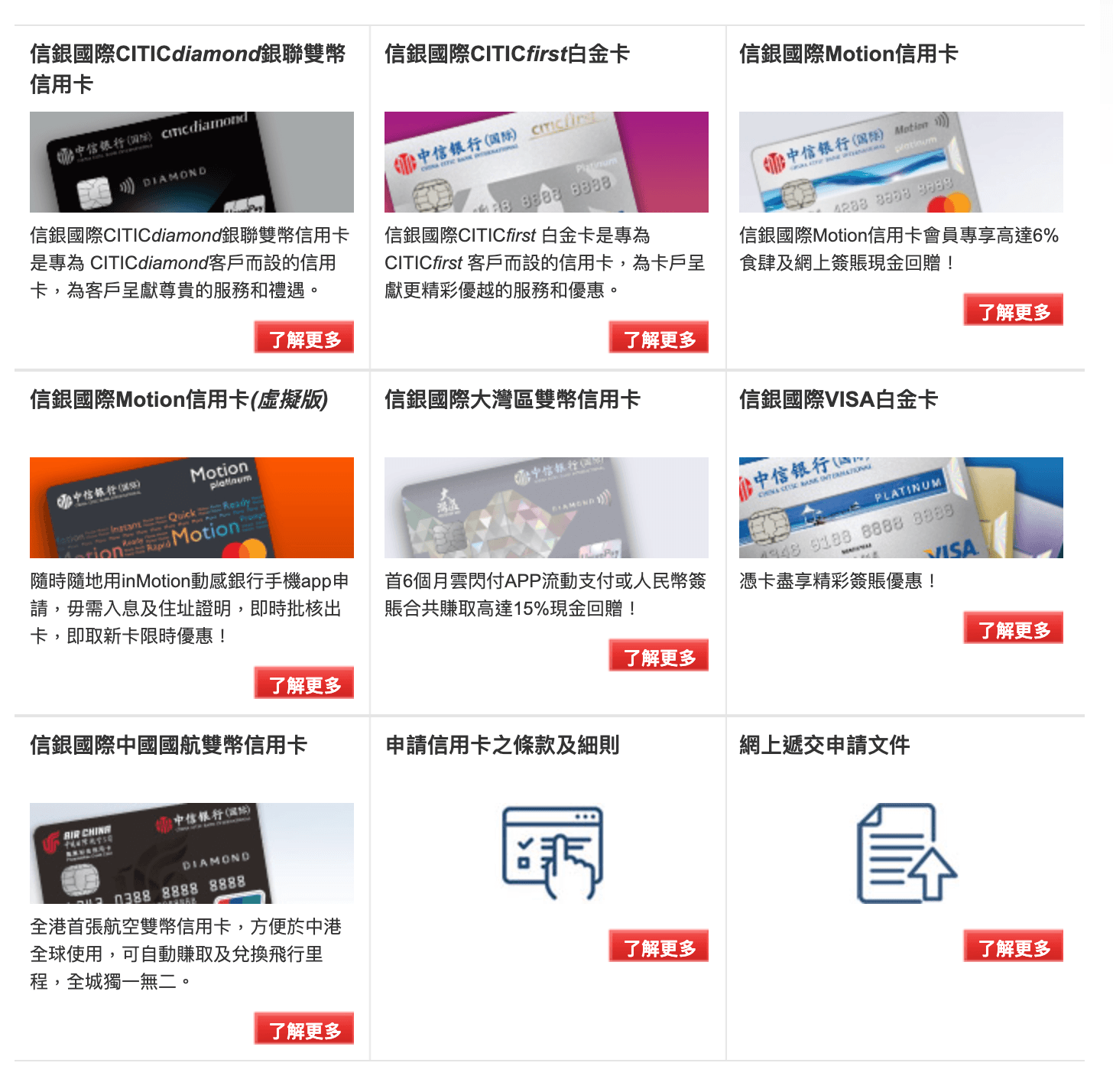

Currently, CITIC International offers the following credit cards:

Since the readers of this article are probably not CITICdiamond / CITICfirst customers who meet the asset requirements, it is recommended not to apply for the first two cards, as being rejected can easily discourage us from applying for foreign cards.

In addition, the only cards that can be applied for through the application form are the Motion Credit Card and the Greater Bay Area Dual Currency Credit Card. (So don't even think about applying for other cards)

Go to the CITIC International official website to download the application form. Although you can see three credit card application forms to choose from.

But in fact, these three options are the same link, so don't think too much, just apply for the Motion Credit Card and the Greater Bay Area Dual Currency Credit Card.

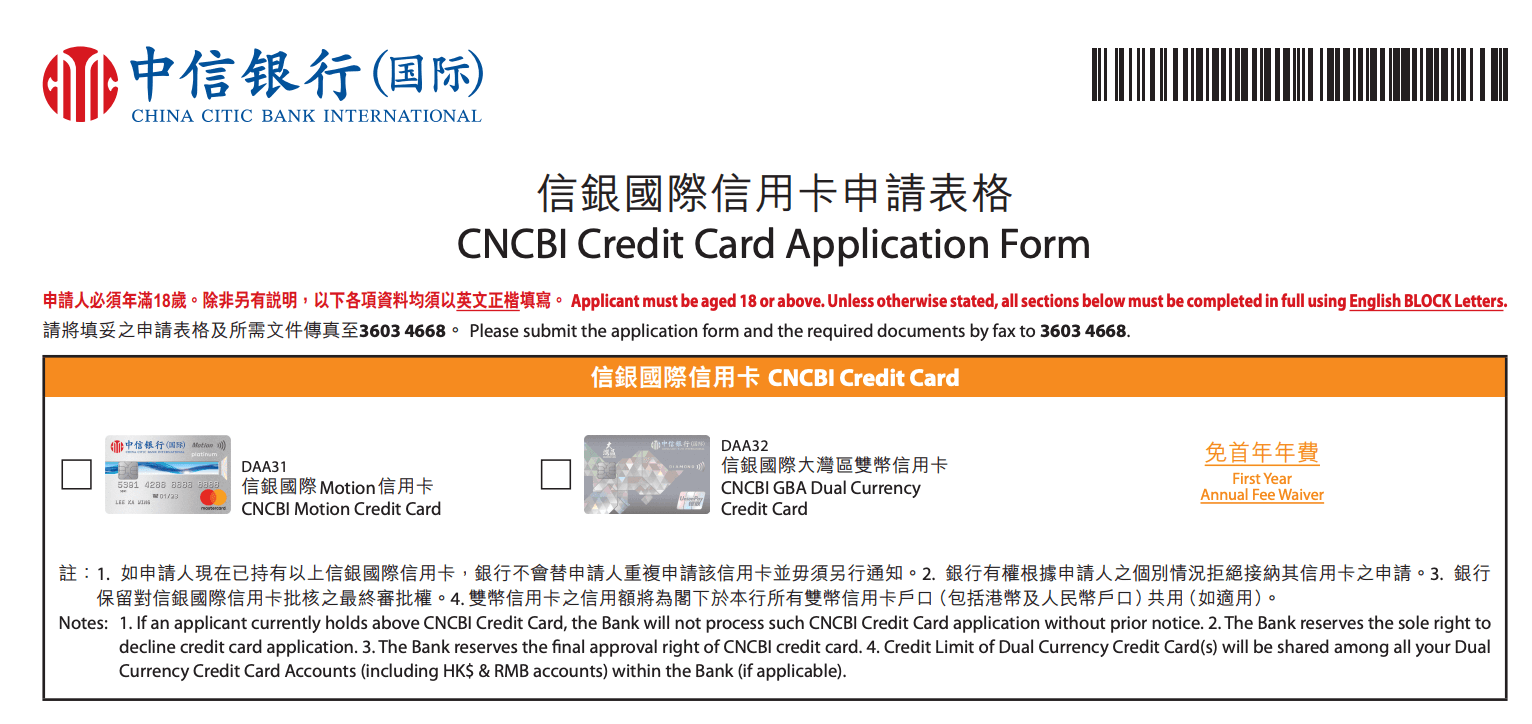

First, select the cards you want to apply for, just check both options.

Then choose the welcome bonus, choose as you like. However, it should be noted that almost all credit cards in Hong Kong have FTF (Foreign Transaction Fee). When transactions are recorded in currencies other than Hong Kong dollars (HKD), the bank will charge a foreign currency exchange fee of 1% - 2.95% or even higher. The UnionPay card from CITIC International (Greater Bay Area Dual Currency Credit Card) does not have FTF fees, and UnionPay can be used on platforms such as Taobao, WeChat, and JD.com, making it relatively easier to complete the welcome offer. Therefore, it is recommended to choose the welcome offer of the Greater Bay Area Dual Currency Credit Card.

Fill in Personal Information#

Next, fill in the form truthfully. It should be noted that

Here, you should fill in the main identification document used when opening a CITIC International bank account. Generally, for users who open an account through CITIC Securities, the main identification document is "Chinese Resident Identity Card". Even if you provided a Hong Kong and Macau Pass or passport as an auxiliary document when opening the account, you should still fill in the ID card number here.

The phone number can be different from the one used for your CITIC International account.

In general, if you want to bind a UnionPay International card to UnionPay QuickPass, there are several requirements:

- The registered number of UnionPay QuickPass must be the same as the bank's reserved number for the card, and it does not necessarily need to be registered with a Hong Kong number.

- The UnionPay QuickPass account cannot bind mainland UnionPay cards. That is, UnionPay International cards and mainland UnionPay cards cannot be bound to the same account.

If you have already registered UnionPay QuickPass with a mainland number, it doesn't matter if the mobile number for the UnionPay International card is also a mainland number. You can modify the mobile number of the existing UnionPay QuickPass account that is bound to the mainland UnionPay card and use another number to bind the mainland card; or you can contact the bank to modify the mobile number bound to the credit card.

However, CITIC International is an exception: If your credit card's reserved mobile number is a mainland number, you will not be able to bind UnionPay QuickPass. If you need to use UnionPay QuickPass, please be sure to reserve a Hong Kong mobile number. CITIC International can basically only modify the reserved number at the branch counter.

The residential address can be a mainland address, and fill in the city + province + CHINA in the "District" field.

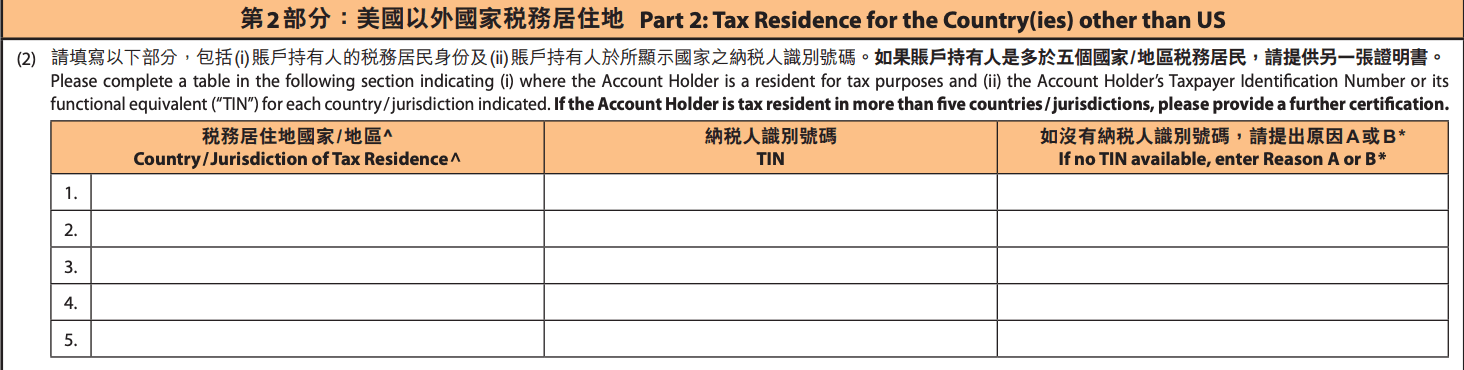

Tax Identification Information#

Do not check any options related to US tax residents for the FATCA part, even if you have an ITIN, do not foolishly write it down unless you really meet the substantial presence test and are considered a Resident Alien. Otherwise, writing a US tax number can make your account opening journey very difficult.

Fill in according to the actual situation, and for those who do not have tax residency in other countries, write CHINA in the tax residence field and write the ID card number in the TIN field.

Occupation#

It is uncertain whether you can fill in work information from mainland China or other countries, but I didn't fill it in. Hong Kong credit card approvals generally only look at proof of address or deposits. If you provide work information, you may need to provide pay stubs and income statements, and it is still unknown whether CITIC International recognizes income statements from non-Hong Kong regions.

Miscellaneous#

"Free ATM Service" means associating your credit card with your CITIC International account so that you can withdraw cash using your credit card at ATMs. If you check this option, the bank will send a separate letter containing the withdrawal PIN code. Whether to enable this feature is up to you.

Just fill in the rest of the form, you can consider refusing to use your personal information in marketing activities, anyway, it is unlikely that mainland residents with ID cards will be invited to apply for cards.

Submitting the Application#

You can call your relationship manager (on your CITIC International account opening paper) to help submit the application, so you don't even need to fill out this form! (Maybe this should be mentioned at the beginning?)

If you have social anxiety or don't want to keep too much money in your CITIC International account (submitting through the relationship manager may have higher deposit requirements), you can also send an email to:

card_doc@cncbinternational.com

Do not continue to use the previous creditcardcs@cncbinternational.com, as the credit card inquiry department generally does not handle new card applications.

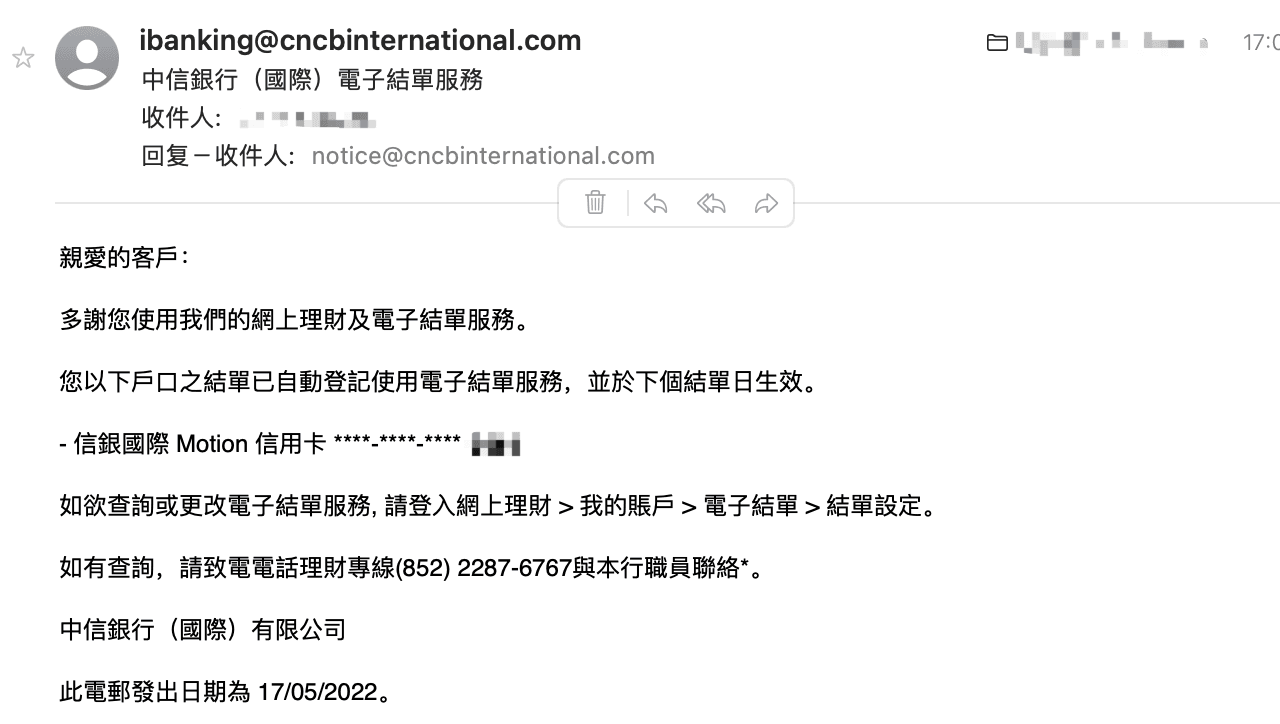

After that, it's a long wait. According to online data points, the card approval time varies from half a month to a month, and there will be no contact during this period. After the card is approved, you will receive a notification that the paperless registration of the card is successful:

Usage#

Apple Pay#

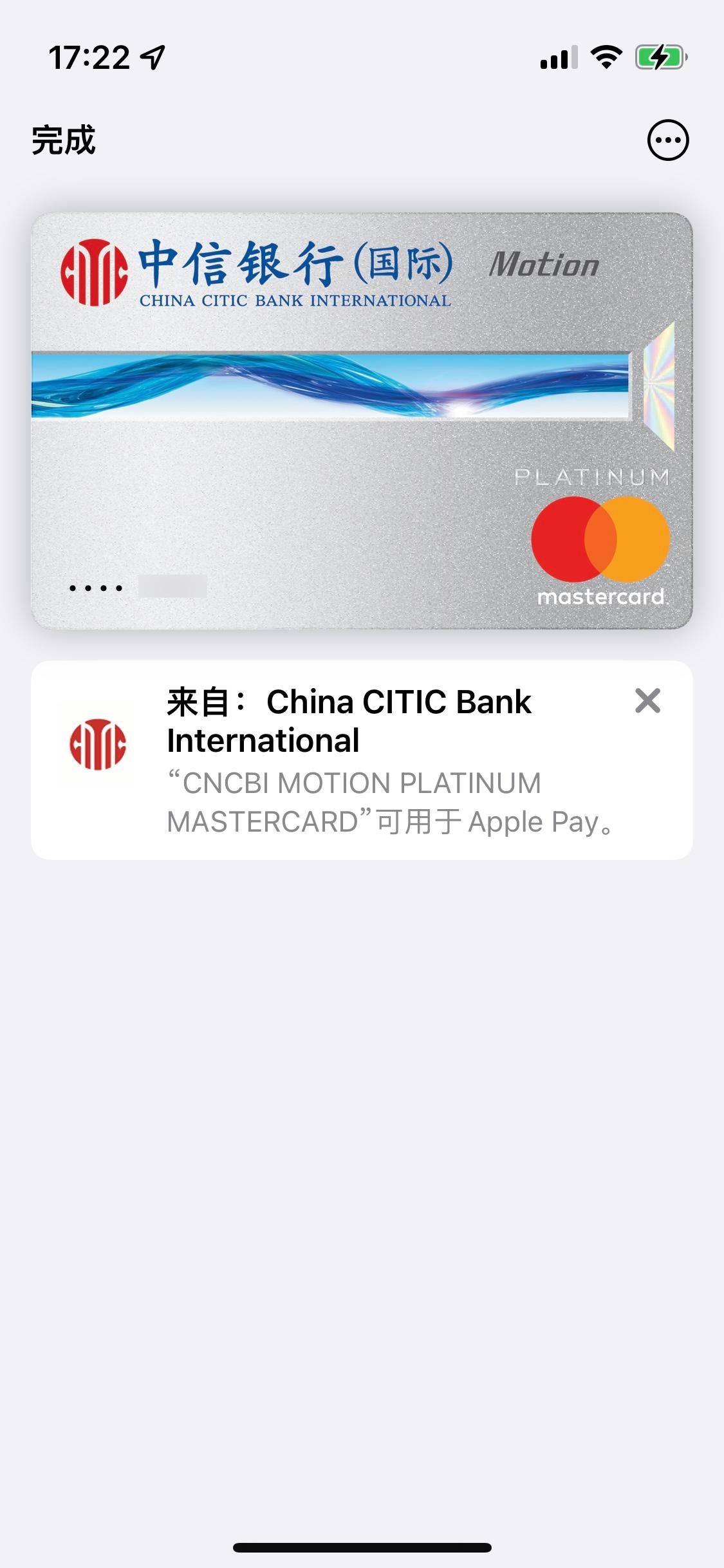

After the card is approved, you can immediately add the card to Apple Pay for use, without waiting for the physical card (but for online transactions that require CVV, you still need to receive the physical card to know the CVV).

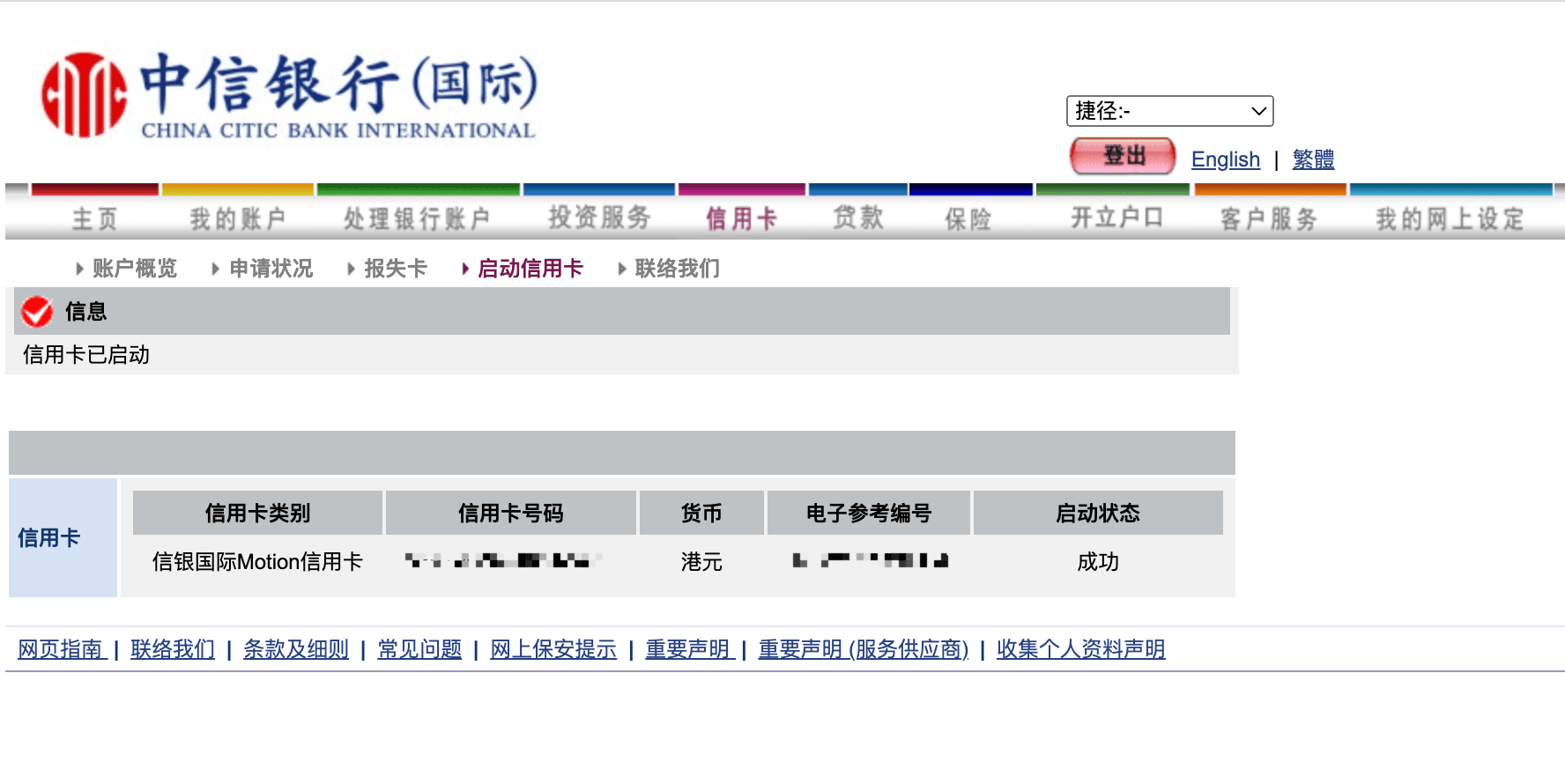

Before binding Apple Pay, you need to log in to the web version of online banking and find "Activate Credit Card" in the new credit card options:

Since I forgot to take a screenshot, the picture can only be used as a reference for the Greater Bay Area Dual Currency Credit Card, but the UnionPay card from CITIC International does not support Apple Pay, so we don't need to activate it before receiving the physical card.

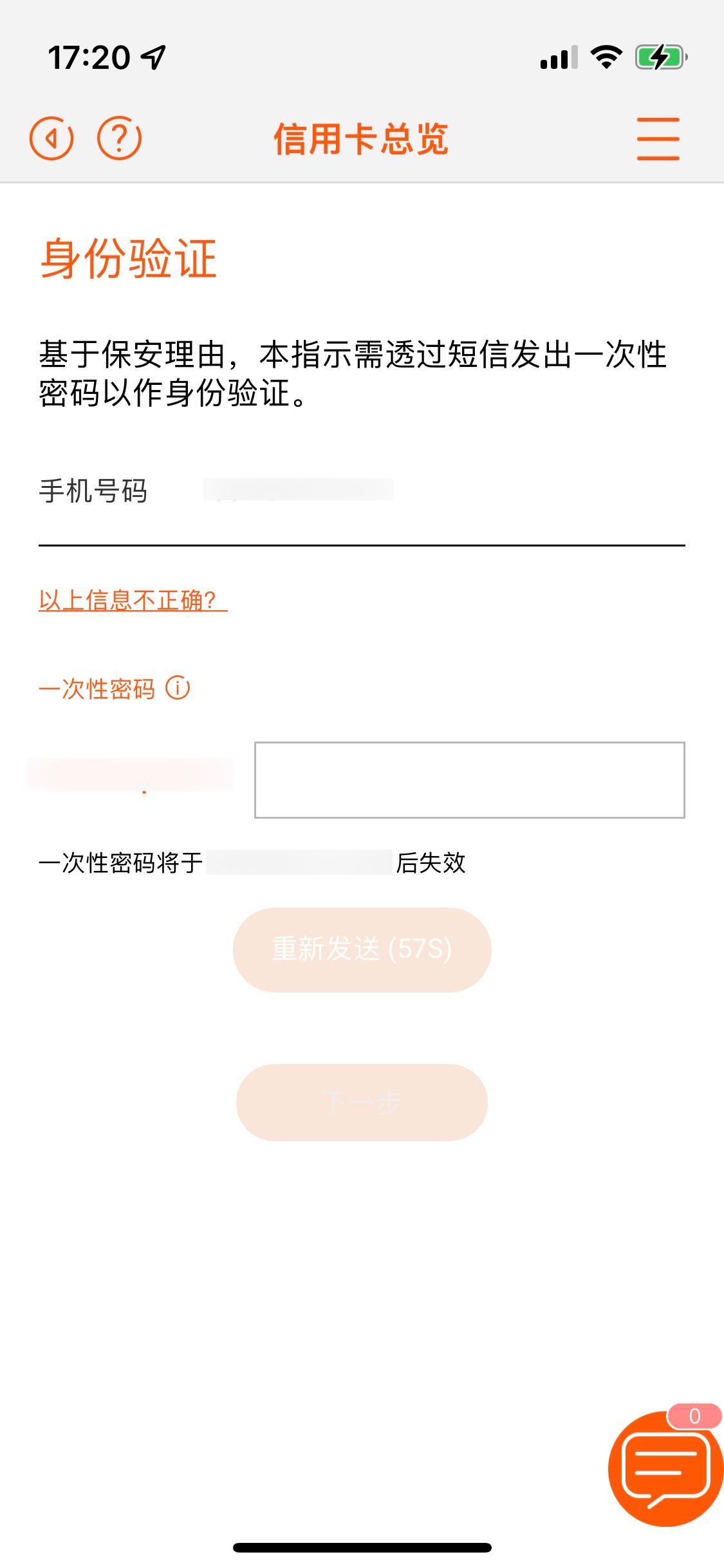

Complete the card activation according to the process, and then you can add the card to Apple Pay on your phone by opening the app: