Disclaimer: The information contained herein is subject to change at any time, without notice. The author and publisher do not guarantee the accuracy, completeness, or suitability of the information provided and accept no responsibility or liability for any errors or omissions. This article should not be construed as offering any form of investment, tax, or legal advice. Always consult with a qualified professional before making any financial decisions. By continuing to read this article, you acknowledge and agree that you are solely responsible for your own financial choices and outcomes.

晒卡#

惯例先晒卡。

首先是实体卡:

目前 HSBC 英国区域的所有卡都已经换成了「新」设计(指猪鼻子和竖版卡),而官网上还是老的卡板:

Apple Pay 上的卡板和官网接近,但是没有金属色泽的 Mastercard World Elite Logo:

如何申请#

提交申请表#

必须已有 HSBC Expat 账户才能申请信用卡。HSBC Expat 目前提供了两张信用卡,Premier World 信用卡和 Premier World Elite 信用卡。其中后者有每年 195 GBP 的年费,但是提供了无限次的 Lounge Key 权益(不可带人,包含餐厅权益),可以认为是花钱买贵宾厅。

申请需要通过表格申请,不能在线申请。你可以点击这里下载申请表格:

你需要打印表格填写并扫描,如果你想要通过电子方式签名,那么不能使用 Adobe / DocuSign 等自动生成的签名,而必须是「手写签名」,即使用你的手指或手写笔 / 触摸板等方式签名。

之后将表格邮寄到

HSBC Expat

HSBC House

Esplanade, St Helier

Jersey, JE1 1HS

或是通过电子邮件发送给 expat.asia.pacific@hsbc.com ,虽然 HSBC Expat 可能会告诉你发送到其他邮箱,但是都存在一定问题:

expatinfo@hsbc.com:不再使用expat@hsbc.com:仅发件,不收件hsbc.expat@hsbc.com:仍在使用,但是经常没人回应

只有 expat.asia.pacific@hsbc.com 可以直接联系到 Relationship Manager Team 并且回复较快。不确定非亚太地区客户是否可以联系他们处理,如果不行那就只能另找其他邮箱地址了。

提交辅助信息#

由于 HSBC Expat 在申请时的门槛很低,因此有大量人开立了 Expat 账户,因此也就拥有了申请信用卡的资格,这导致以前有相当数量的人申请并获批信用卡后刷爆跑路(Busting Out)。Busting Out 行为通常是和 Synthetic Identity Fraud (SIF) 行为联系在一起的,因为很少有人会傻到拿自己的身份去做这种犯罪。Synthetic Identity Fraud (SIF) 的意思是,编造一个新的身份,拿这个凭空捏造出来的身份去建立信用记录、申卡、套现。

为了降低这种犯罪对自己的影响,Expat 不知从何时开始对信用卡申请要求了额外的文件,这包括公证的身份证明和地址证明。这给我们申请 Expat 信用卡带来了极大的不便。

对于大中华区地区的读者而言,搞定这些证明有这些方案:

- 台湾:台湾的政府部门可以提供护照公证

- 香港 / 澳门:直接前往 HSBC HK 总部的 Expat Branch 或国际银行部处理

- 大陆:联系国际银行部前往指定汇丰分行,可以同时公证护照和地址证明(HSBC CN 月结单)

但是这些方案都可能不被 HSBC Expat 接受,因为 HSBC Expat 要求公证员必须在公证上附注:“I confirm that this is a true and accurate copy of the original document”,如果文件上包含照片(Photo ID),则还必须附注 “and that the photograph bears a true likeness to the individual requesting the certification.”。而这些要求,无论是台湾政府机构或者是汇丰中国分行都拒绝满足,尚不明确香港国际银行部是否愿意帮助满足这些要求。

在线远程公证#

那么,对于全球读者(非制裁地区)都适用且成本低廉的解决方案就是通过在线公证了。我们可以从 Fivver 上找到一名公证员,通过视频见证的方法公证。经过多个案例实测,HSBC Expat 接受这些公证文件,而 Fivver 上的公证员绝大部分都愿意帮你添加 HSBC Expat 所要求的附注。

- 首先你需要注册 Fivver 账户,如果你通过此邀请链接注册,那么你可以获得首个订单 10% OFF(即九折)优惠。

- 然后搜索「Notarize」相关的服务,此类公证的费用应该在 10 - 20 USD 为合理区间。

- 联系卖家(Seller)是否可以提供护照和地址证明的公证,并询问是否可以在公证文件上添加上述的加注。

- 下单后和卖家预约视频会议时间,然后完成公证即可。这需要你有基本的英语听说能力,因为公证时会询问一些问题,包括最基本的身份信息(你的名字、出生日期等)和例行询问(你是否出自自愿,是否有人强迫你等)以及宣誓(部分卖家可能会帮你念宣誓内容,你只需要回答 Yes,但是也有需要你跟着一起念的)。

- 将公证后的文件仍然发送给

expat.asia.pacific@hsbc.com。

不知道选择哪个卖家?你可以尝试本文作者所合作过的卖家,只需要点击这里。此卖家并不对外国人额外收费,并且整个流程简单快速,不需要太高英文水平。除了回答自己的个人信息外基本只需要回答 Yes 和 No 即可。如果你的英语听力能力较弱,可以尝试在视频会议时使用 Google 的实时转录 + 翻译功能。

除 Fivver 引荐链接外,本文作者并未和上述的任何机构、组织或个人有任何商业合作。提供这些信息仅出于文章完整度和读者便利性考量。本站不对 Fivver 卖家提供的服务提供任何担保或连带责任。使用 Fivver 引荐链接注册将使本站获得你首个订单交易金额 10% 的收益(不超过 100 美元)。Fivver 上的内容可能随时发生变化,本站不对其内容有效性作出任何担保。

申请注意事项#

- 你地址证明上的地址写法必须和 HSBC Expat 系统内的写法完全一致,不能有任何差异。如果不一致,需要先在 HSBC Expat 网银内更新地址

- 信用卡申请表中的 Direct Debit 账号可以填写 Expat 的英镑账户。其中 Expat 提供给你的账户号码中的前六位为 Sort Code,后八位为账户号码。只要保持 Expat 英镑账户内有足够资金,信用卡就会自动从中扣款来支付欠款。

后续使用#

英国信用#

相信很多人申请 Expat 信用卡的目的就是为了建立英国信用。听起来确实是非常好的方案,毕竟 HSBC 起批额度会比较高(一般固定为 5,000 GBP,如果在 Expat 有足够存款可能会更高),更有利于建议信用。

但是,如果想要 HSBC 上报信息给英国信用局,那么必须更改 HSBC Expat 的「居住地址」为英国地址。这是一个有风险的操作,因为 HSBC Expat 的整体风控都较为敏感。有案例在修改地址后被要求重新填写 CRS (自我税务申报)表的,也有被 HSBC 风控要求改回原来地址的。

总之,Use at your own risk.

还款#

如果你在申请表填写了 Direct Debit 信息,那么 HSBC 会自动在还款到期日从对应账户扣款,只需要保持账户中有足够资金即可。

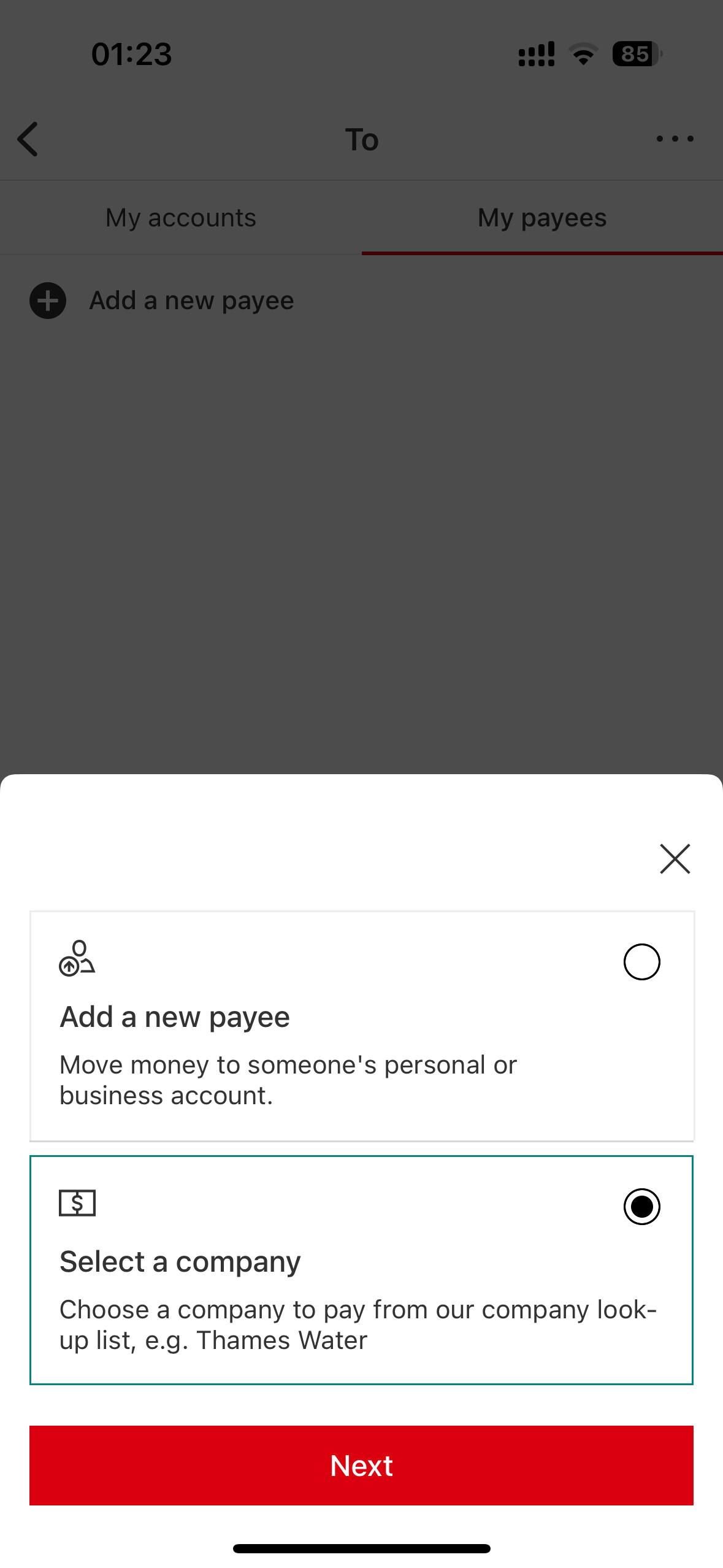

如果你想要主动还款,那么在 HSBC Expat / UK 的还款可以通过 Bill Pay 进行。以 HSBC UK App 为例,在添加 Payee(收款人)时选择付款给公司:

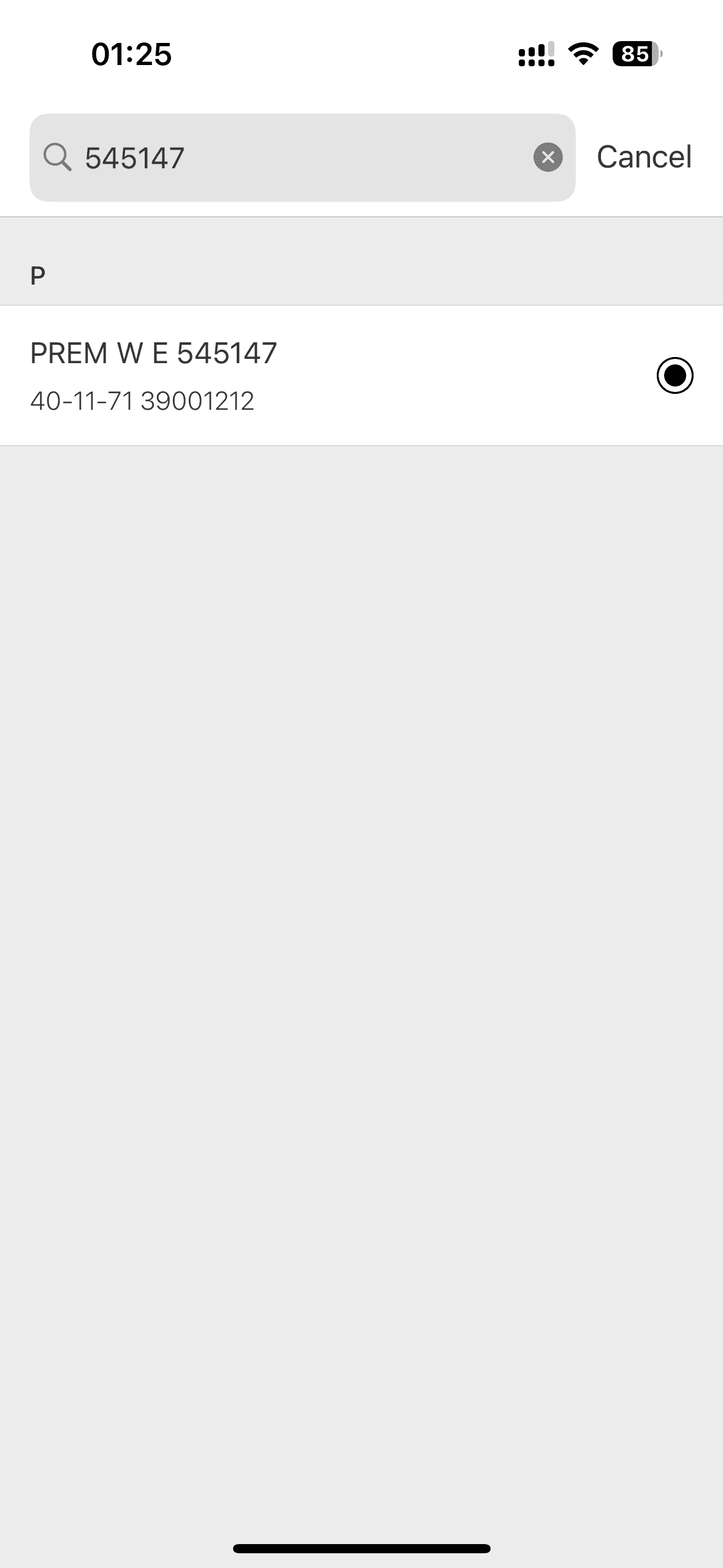

只需要搜索 Payee(收款人)并且填入你信用卡卡号(即 BIN)的前 6 位数字。例如我的 Premier World Elite 是 545147 ,那么收款人就是 PREM WE 545147 。

然后在「Reference」填入你的信用卡完整卡号:

即可完成付款。

HSBC UK 的账户提供 Outbound FPS。FPS 即 Faster Payment Service,快速转账服务。可以近乎即时地将款项转入对方账户。通过 HSBC UK 进行信用卡付款,一般会在第二个工作日看到入账(虽然即时到账了,但是看起来需要人工处理入账)。

HSBC Expat 的账户仅支持 Inbound FPS,因此付款出去只能走传统系统,需要很长时间才能入账,一般需要 4 - 5 个工作日。有条件还是用 HSBC UK 吧。

如果你想要通过其他英国金融机构付款,那么流程也是类似的。部分银行(如 Monzo)可能不提供 Bill Pay 功能,也就无法搜索 Payee,你就只能自行查找并填写这些信息了。注意同样需要在 Reference 填写你的完整信用卡号码。

如果你也是申请的 Premier World Elite 卡,并且和我有相同的 BIN,那么下面提供了收款人信息:

PREM WE 545147

Sort Code: 40-11-71

Account Number: 39001212

注册网银#

HSBC Expat 本质上是 HSBC CI & IoM(Channel Islands and Isle of Man,海峡群岛)的一个特殊分行,因此其信用卡也是 HSBC CI & IoM 发行的。HSBC CI & IoM 的银行账户只限海峡群岛居民申请,但有了这张信用卡以后,你可以注册单独的 CI & IoM 网银。

在收到卡片并激活后,拨打 +44-0345-600-6161 (英国内)或 +44-1470-697-139 (英国外)设置 TSN(Telephone Security Number)。拨打后自动语音系统会要求你输入卡号,并且以「两位数日期 - 两位数月份 - 年份的最后两位数字」的格式输入你的生日。之后系统会告知你需要设置 TSN,并且把你转接给人工客服。告知客服你想要设置 TSN,客服会询问你的个人信息以作验证。注意回答机会只有一次,如果回答错或与系统信息不符,那么就会被要求去线下分行验证身份。

如果客服建议你设置 Voice ID,本站建议你拒绝。HSBC UK 的 Voice ID 不知为何很难使用,经常无法正确验证,而且还无法降级到 TSN。一旦 Voice ID 验证失败,那么就只能由客服人工验证信息。

设置好 TSN 后就可以前往 HSBC CI & IoM 官网注册网银了。网银的大部分功能都无法使用(因为没有银行账户),相比之下只是可以更快地查看到交易记录等信息。

注意事项#

- 寄送卡片:HSBC Expat 会通过 DHL 寄送借记卡,但信用卡却拒绝使用 DHL 寄送而只使用平信(Normal Mail)寄送。对于绝大多数中国大陆居民而言,收到平信可能会比较难。那么我是不是可以换到英国地址去收取卡片呢?答案是否定的。有案例表明,在激活卡片前修改地址会导致信用卡被取消,需要重新申请。

- 年费:如果申请的是有年费的 Premier World Elite 卡,那么会在首个账单期收取年费,不要忘记在 Direct Debit 账户中留存足够资金,或者主动还款。

- 补 / 换卡:如果你有任何会导致卡号变更的操作,例如补 / 换卡。就需要致电 HSBC Expat 的客服要求他们更新网银上的信用卡卡号记录。因为 Expat 和 CI & IoM 系统之间的唯一联系就是卡号。如果你的卡号发生了变更,Expat 系统并不会获知这一变更,然后你就无法通过 HSBC Expat 的网银或 App 查看到交易记录和账户结欠了。

- 地址验证:英国有和美国一样的信用卡地址验证服务(AVS)。在大部分在线交易中会要求你提供邮编并进行验证。很遗憾 HSBC CI & IoM 并未像 HSBC US 一样考虑国际用户的使用。如果你的地址不在英国,那么你将无法通过 AVS。解决办法是联系 CI & IoM 客服并且要求他们在你的通讯地址(Correspondence Address)中添加一个英国地址。使用这个英国地址的邮编就可以通过 AVS。

- 电话的自动系统:CI & IoM 的客服系统本质上是 HSBC UK 的客户系统。因此如果你同时拥有 HSBC UK 账户,那么就不要使用 UK 所关联的电话号码致电去处理与此信用卡有关的事务。因为电话系统会识别你的来电号码并且自动关联到你的 HSBC UK 账户,而这张信用卡和你的 UK 账户并无任何关联,客服会无法处理相关信息,反而可能认为你存在身份盗用而要求你去线下分行验证身份。