This article does not constitute any advice on credit; please consult a professional.

This article is still in progress, and the information may change.

Overview#

FICO (Fair Isaac and Company) is the most widely used credit scoring system in the United States, with FICO Score 8 being one of the scores widely used by lenders to assess individuals' revolving credit (other scores like FICO 2 / 3 / 4 / 9 / 10 are used in different areas, such as mortgage loans and auto loans).

The method FICO uses to execute credit scoring is proprietary. However, it has been in operation for so many years and used in a sufficiently broad range of fields that we have the opportunity to speculate on how it works by analyzing a large enough sample. As of April 2020, the MyFICO forum had nearly 300,000 users and over 4 million posts, providing ample opportunity for people to try to understand the FICO scoring mechanism.

Due to the existence of over 28 different FICO models, strategies that are effective for one model may not apply to another. Since this article primarily provides references for applying for and managing credit cards, it will focus on studying FICO 8.

Lenders assess the risk of a borrower defaulting in the future using the FICO 8 score, which is generated by extracting data from the three major credit bureaus (Equifax / Experian / TransUnion). Since the credit data recorded by each bureau is different and the algorithms used also vary, the FICO scores from each bureau may differ. However, FICO 8 has made efforts to reduce score discrepancies between different credit bureaus, generally resulting in a maximum score difference of +/- 30 among bureaus with the same credit data. FICO 9 further reduces this discrepancy.

Quick Reference (TL;DR)#

Terminology Definitions#

- Revolving Credit: A type of credit that allows borrowers to use it repeatedly within a pre-approved limit by the lender, with credit cards being the most typical example.

- Authorized User: A person allowed to use the credit account added by the primary cardholder, commonly known as a "secondary cardholder."

- Retail Accounts: Generally refers to various store cards. These cards are also issued by banks and provide cardholders with revolving credit limits, similar to credit cards. However, these cards do not belong to card organizations and can typically only be used at specific stores.

- Consumer Finance Accounts: Offered to customers with low credit ratings. These customers find it difficult to obtain traditional loans or credit cards, and consumer finance loans are financial products provided to these subprime borrowers, generally with higher interest rates.

- Loan Modification: Also known as "debt restructuring." Refers to any action that modifies the original loan contract; generally, any loan can be modified. It may be considered a negative credit record.

- AZEO / All Zero Except One: A strategy to improve FICO scores. Specifically, it involves paying off all current balances before the credit card statement generation, leaving only one card with a small balance.

How to Improve Credit Scores?#

For the attributes that constitute the best FICO 8 score:

| Scoring Feature | Attribute |

|---|---|

| Payment History | 100%, no late payments. Most negative records will completely disappear after 7 years, with a few exceptions. A late payment of over 60 days will severely impact the credit record. |

| Ratio of Revolving Credit and Installment Payments to Total Credit Limit | No more than 9.5% |

| Number/Percentage of Accounts with Outstanding Debt | Recommended not to exceed 20%. This metric has a smaller weight in FICO 8 and varies by different credit bureaus and scoring cards. Experian's FICO 8 is less sensitive to this. |

| Age of Oldest Account (AoOA) | Not a scoring factor. Over 3 years will be considered a "clean" profile by FICO 8 / 9. |

| Age of Oldest Revolving Account (AoORA) | Misunderstood as a scoring factor for AoOA. However, if the oldest account is a revolving account, then AoORA = AoOA |

| Average Age of Accounts (AAoA) | 90 months is considered the maximum beneficial value for scoring. |

| Average Age of Revolving Accounts (AAoRA) | Is a scoring factor. Similar to AAoA, but revolving accounts always have a higher scoring weight. |

| Age of Youngest Account (AoYA) | Is a scoring factor and can sometimes be beneficial for scoring. |

| Age of Youngest Revolving Account (AoYRA) | Over 12 months will be considered a "clean" profile by FICO 8 / 9. |

| Recent 12-Month Inquiries (generally referring to hard inquiries) | 0. Any hard inquiry's negative impact on the score will be eliminated after 365 days. |

| Total Number of Accounts / Total Credit Mix | Not a scoring factor. Having more than one loan can yield the maximum benefit for credit scoring, while having none or too many loan accounts may negatively impact the score. It is a separating factor for clean profiles. Generally, 4 Trade Lines (TL) are considered a "thick" account. Maintaining a credit ratio of 4:1 or 3:1 between revolving credit and general loans may be a good choice. |

Analysis#

How Does FICO Work?#

Borrowers' credit data is divided into 5 parts and entered into credit bureaus for evaluation. This data enters the respective CRA (Credit Reporting Agency) FICO black box and is calculated through the corresponding "scorecard" (algorithm), which assesses the borrower's data based on these 5 categories and generates credit scores and negative factor codes, which are listed in order of priority. The rating and score range for FICO 8 is:

| Rating | Score Range |

|---|---|

| Excellent | 800 - 850 |

| Very Good | 740 - 799 |

| Good | 670 - 739 |

| Fair | 580 - 669 |

| Poor | 300 - 579 |

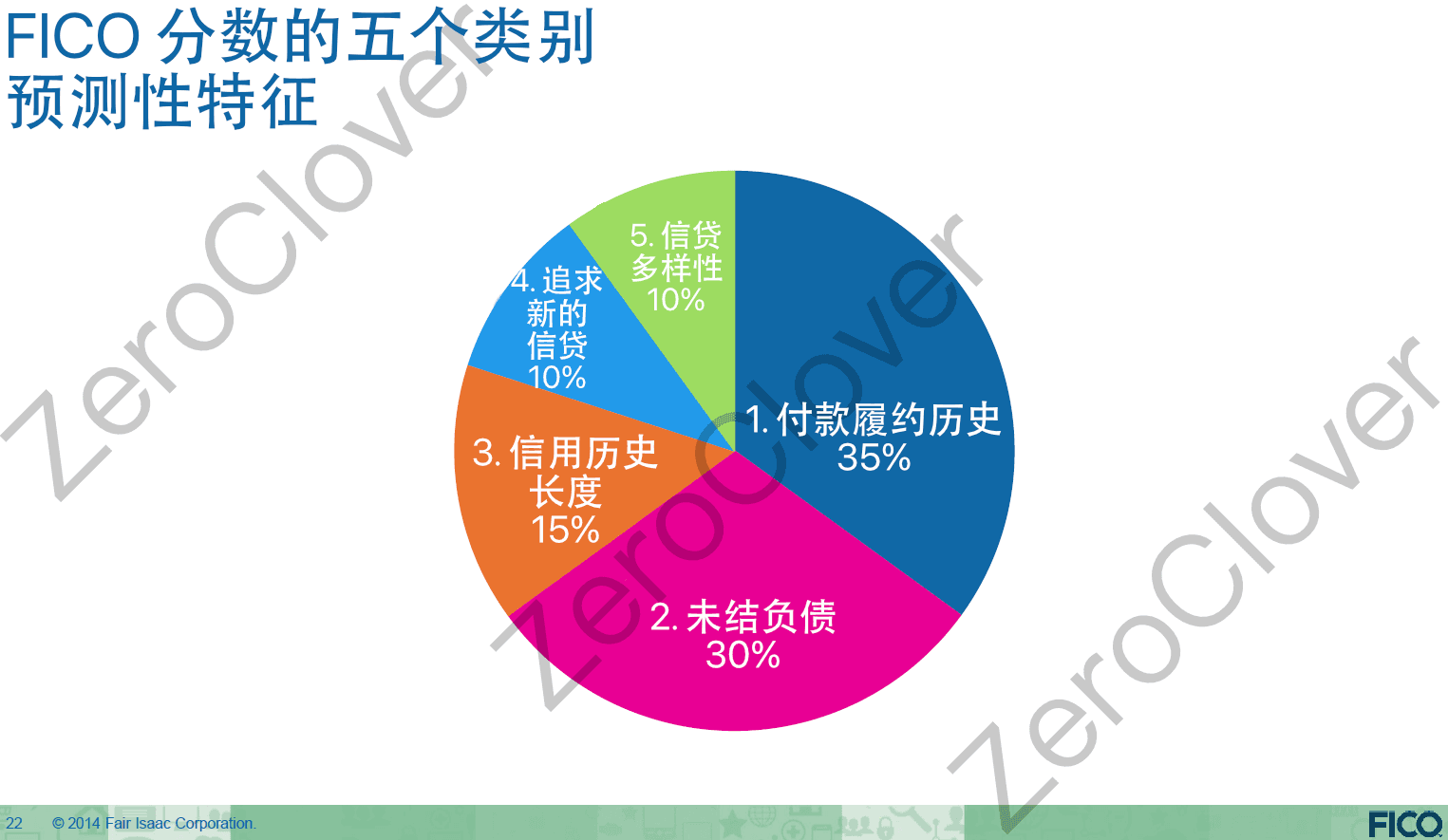

The behaviors assessed to generate the FICO score from credit report data and their weights are:

| Category | Weight |

|---|---|

| Payment History | 35% |

| Amount of Debt | 30% |

| Length of History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

It is important to note that credit scoring is related to whether lenders approve the borrower's credit application, but it is usually not the only factor or determining factor. Inquiries into credit records are primarily used for:

- Generating credit scores and negative factor codes

- Analyzing the borrower's credit report

- Notifying other lenders seeking credit (only during hard inquiries, i.e., Hard Pull)

This information is used to determine whether to approve credit, interest rates, terms, and initial credit limits. Credit scores are important, but lenders also consider other factors and those not included in the credit report, such as income and housing expenses. Note that income is not reported to credit bureaus and is not part of the scoring; lenders will consider it separately.

Scorecard#

Each category has different metrics. FICO refers to each metric as a "feature," and the corresponding value is called "attribution." To refine further, we divide features into two categories: "segmentation factors" (also known as "segment factors") and "scoring factors." Segmentation factors determine which scorecard to use, while scoring factors directly affect credit scores, with their "signal strength" (i.e., weight) varying by scorecard. Simply put, a scorecard is an algorithm that generates credit scores and negative factor codes based on data from credit reports.

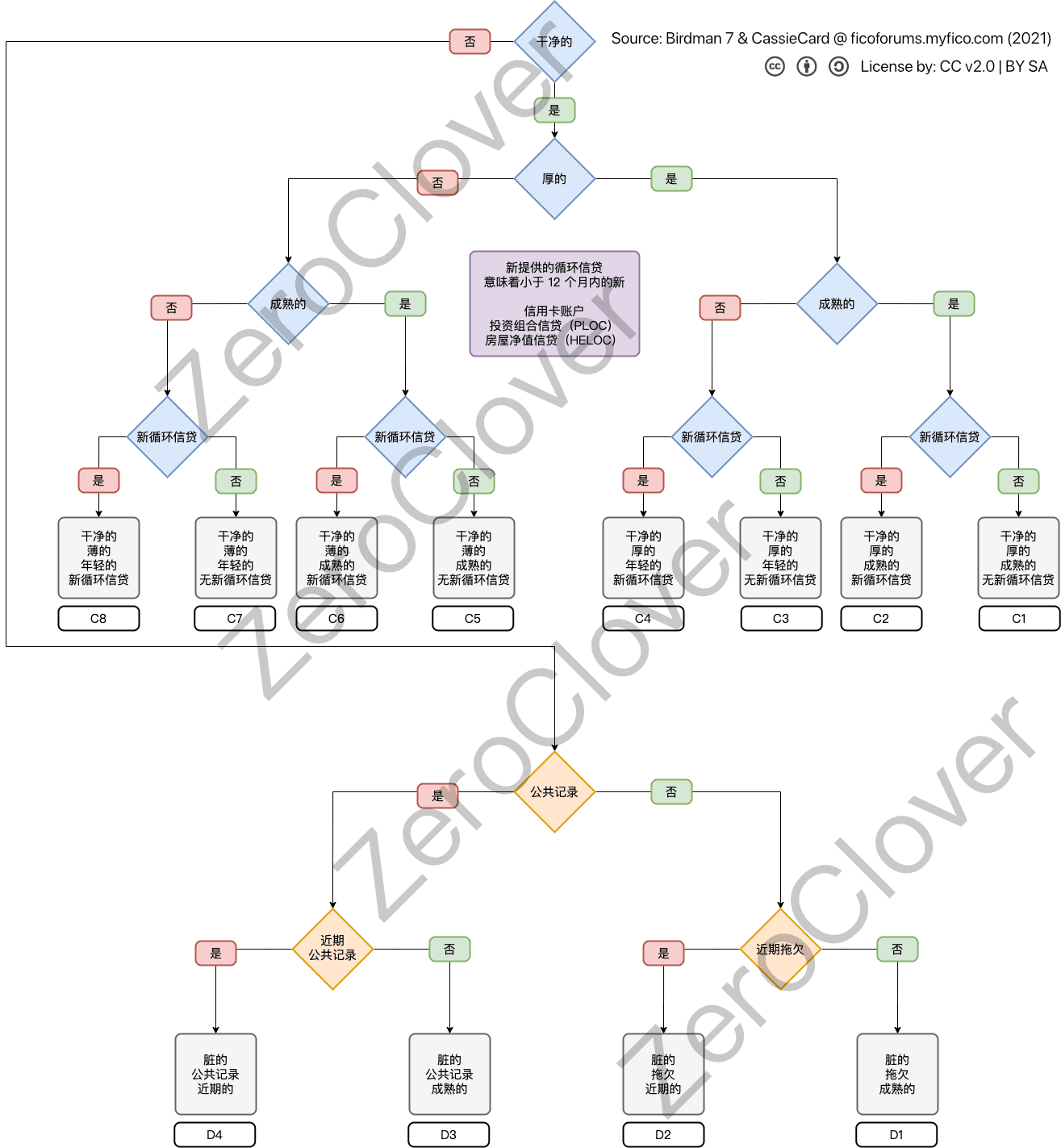

FICO 8 has 12 scorecards, consisting of 8 clean scorecards and 4 dirty scorecards. The scorecard assigned to a borrower depends on the "segmentation factors." For clean credit profiles, these segmentation factors include:

- Thin / Thick (number of accounts)

- Mature / Young (age of the oldest account)

- New Accounts / No New Accounts (recency of revolving credit accounts)

For dirty profiles, I believe the segmentation factors mainly are:

- Severity

- Recency

Scorecard assignment is a complex issue, which we will discuss in another article. What borrowers need to understand about scorecards is how they affect specific scores and how they respond to information in the borrower's credit report, which is why individual credit profiles may react differently to the same event compared to other borrowers. The assignment of a single borrower's scorecard determines the maximum and minimum scores, as well as which negative factor codes apply, and the signal strength (weight) of various scoring metrics described below.

Each scorecard targets specific credit profiles. Scorecard reassignment occurs when scorecards change. This can lead to a drop in credit scores; for example, when using a higher-level scorecard, a borrower is essentially moved from the top of one tier to the bottom of a new tier. This means the borrower will now be compared to a group with better credit status, resulting in a score drop, and vice versa. However, be aware that there are many unexpected theoretical outcomes, and scorecards are very complex. For instance, in FICO 8 / 9, when a borrower is reassigned to a mature account scorecard, most borrowers with a 3-year AoOA status experience a significant score drop.

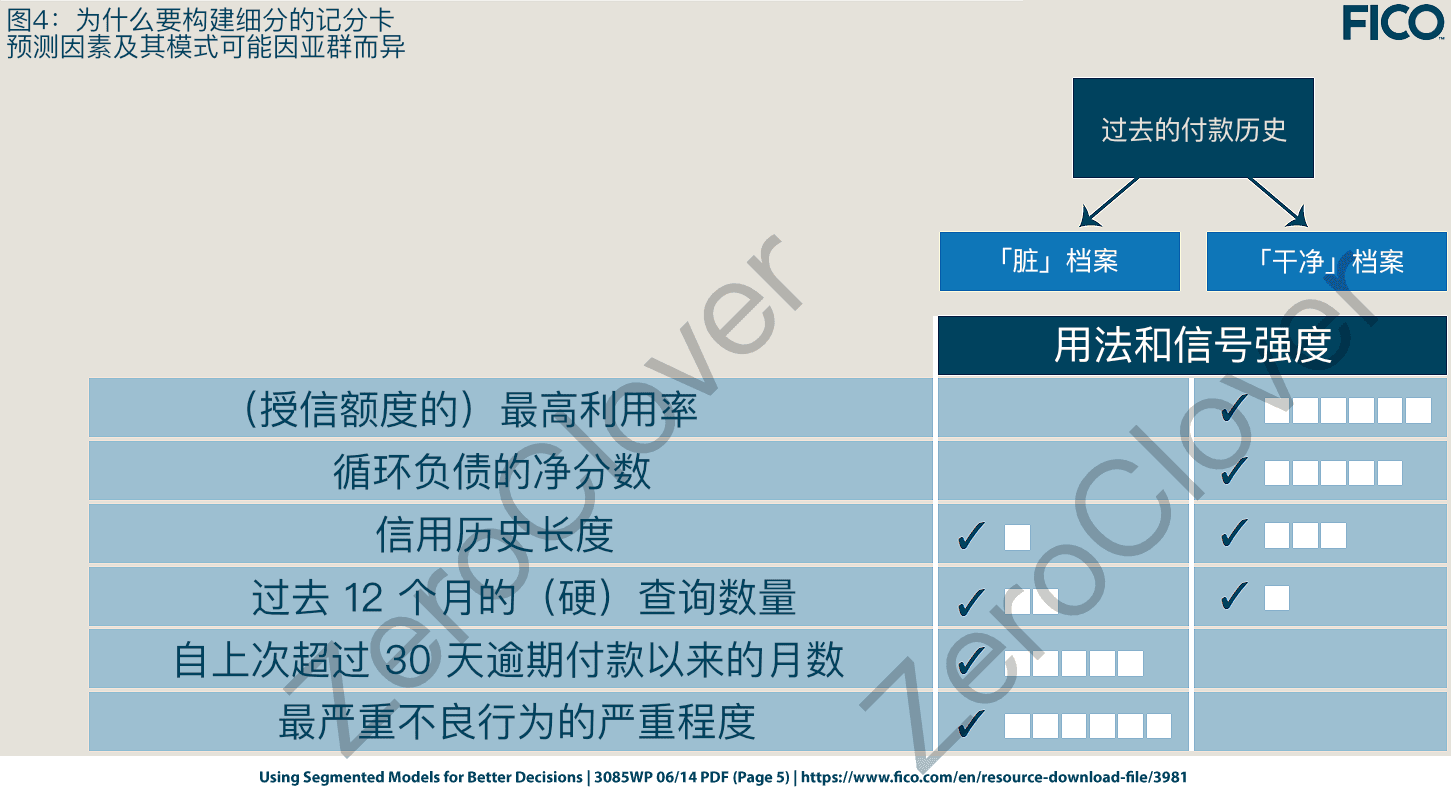

Here is an example of how different scoring factors can have different signal strengths based on scorecards:

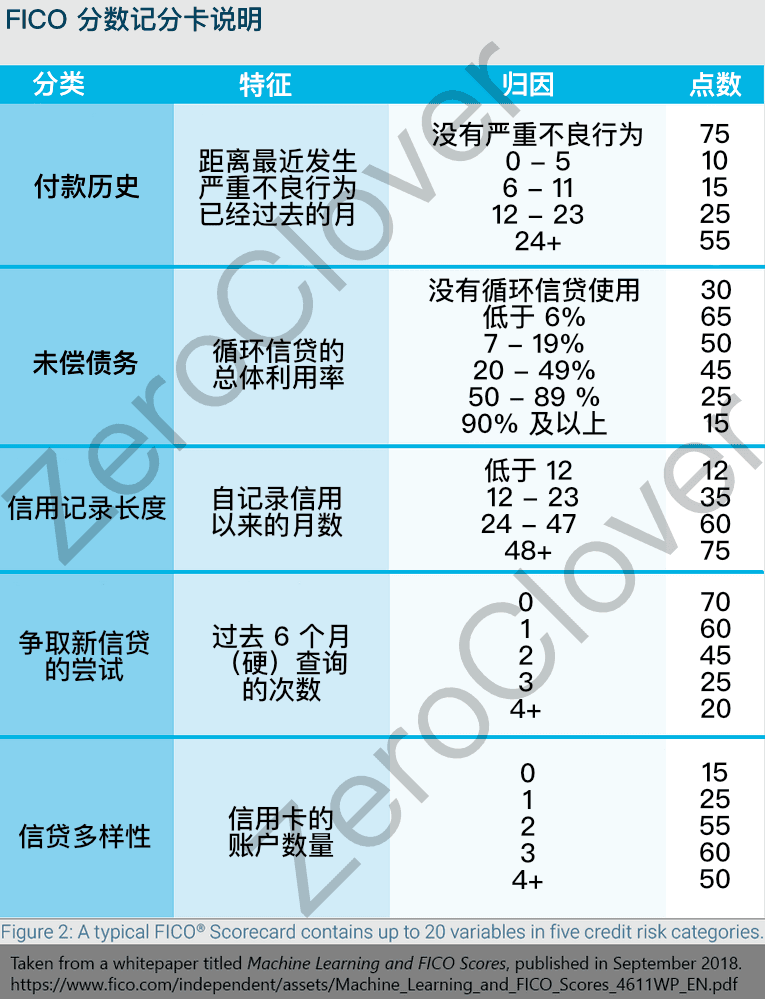

Below is an example of scorecards for payment history, amount owed, length of credit history, new credit, and credit mix (remember, scoring rewards vary by individual profile, and there are far more scoring factors in each category):

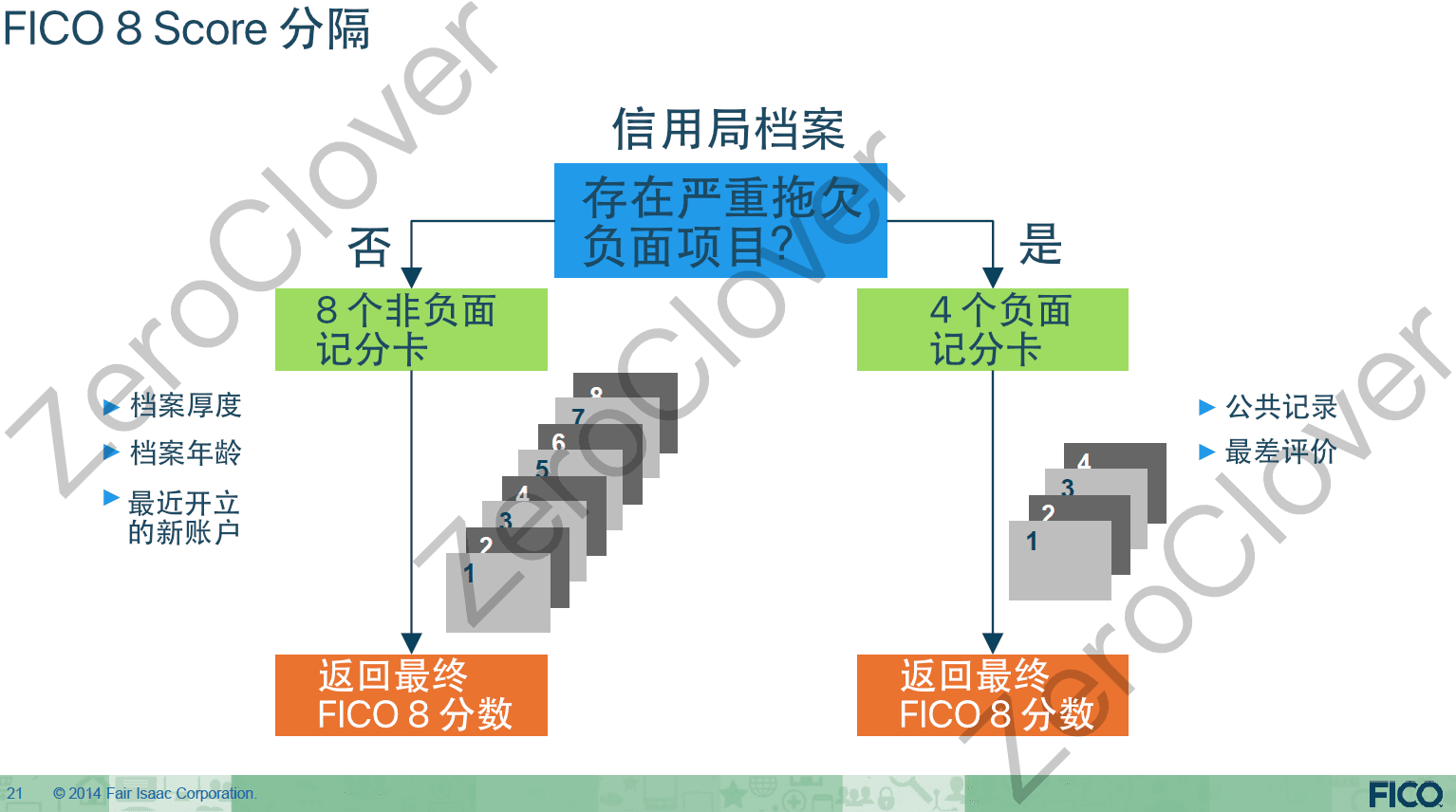

FICO 8 has 12 scorecards (rumored to have 14, but that's not true; 2 scorecards were canceled due to issues with authorized users). It includes 8 scorecards for "clean" profiles and 4 for "dirty" profiles. "Clean profiles" and "dirty profiles" are the first segmentation factors that determine the subsequent segmentation path. A clean credit profile will subsequently be segmented into "thick / thin," "mature / young," and "no new revolving credit / new revolving credit." As we progress through the categories, we will discuss these in more detail.

Conversely, if the credit profile is "dirty" (e.g., late payments over 60 days), the subsequent divisions are less well-known. However, I believe personal credit profiles will be segmented into PR (Public Records) cards or delinquency cards (i.e., classified by the severity of negative records), and then further segmented by recency into "mature / young" cards.

Personal credit profiles containing collections, bankruptcies, or other public records will be segmented into PR scorecards, such as tax liens (including delinquencies). Civil judgment records from courts will also lead to credit profiles being segmented into PR scorecards. However, due to the NCAP (National Consumer Assistance Plan) implemented since 2017, these records are generally no longer reported.

Below is my approximation of how scorecards are divided in FICO 8:

For delinquencies (rather than being sent to collections), if not fully paid, recency seems to depend on the last update date; if fully paid, recency seems to be calculated from the settlement date. Therefore, once payment or settlement is completed, the recency of the delinquency seems to be frozen.

Thus, we now know that scorecards can be divided into clean/thick/mature/no new revolving credit or dirty/public records/delinquent, etc. You do not need to be an expert in this area; just know that this is part of the reason different personal profiles react differently to similar behaviors. Additionally, certain behaviors incur penalties in some scorecards while others do not. For example, in "dirty" scorecards, new revolving accounts incur no penalties, while in "clean" scorecards, there is a penalty of 10 - 20 points (mature accounts incur less penalty than young accounts). Furthermore, in "clean" scorecards, utilization is also more important. Below is a slide from FICO that very broadly describes the segmentation of FICO Score 8:

(FICO 9 added a 13th scorecard for those with high revolving credit utilization. The specific details of how it works or how you are assigned to this card are still unclear; it only applies to those with high revolving credit utilization.)

Now, we will examine each category and its segmentation and scoring factors in detail in sections 1-5 below. I will use the terms segmentation factors and scoring factors, as they are more refined than the general term features, which does not indicate whether it is used for segmentation or scoring.

The Five Categories of FICO Scores#

1. Payment History (Clean / Dirty)#

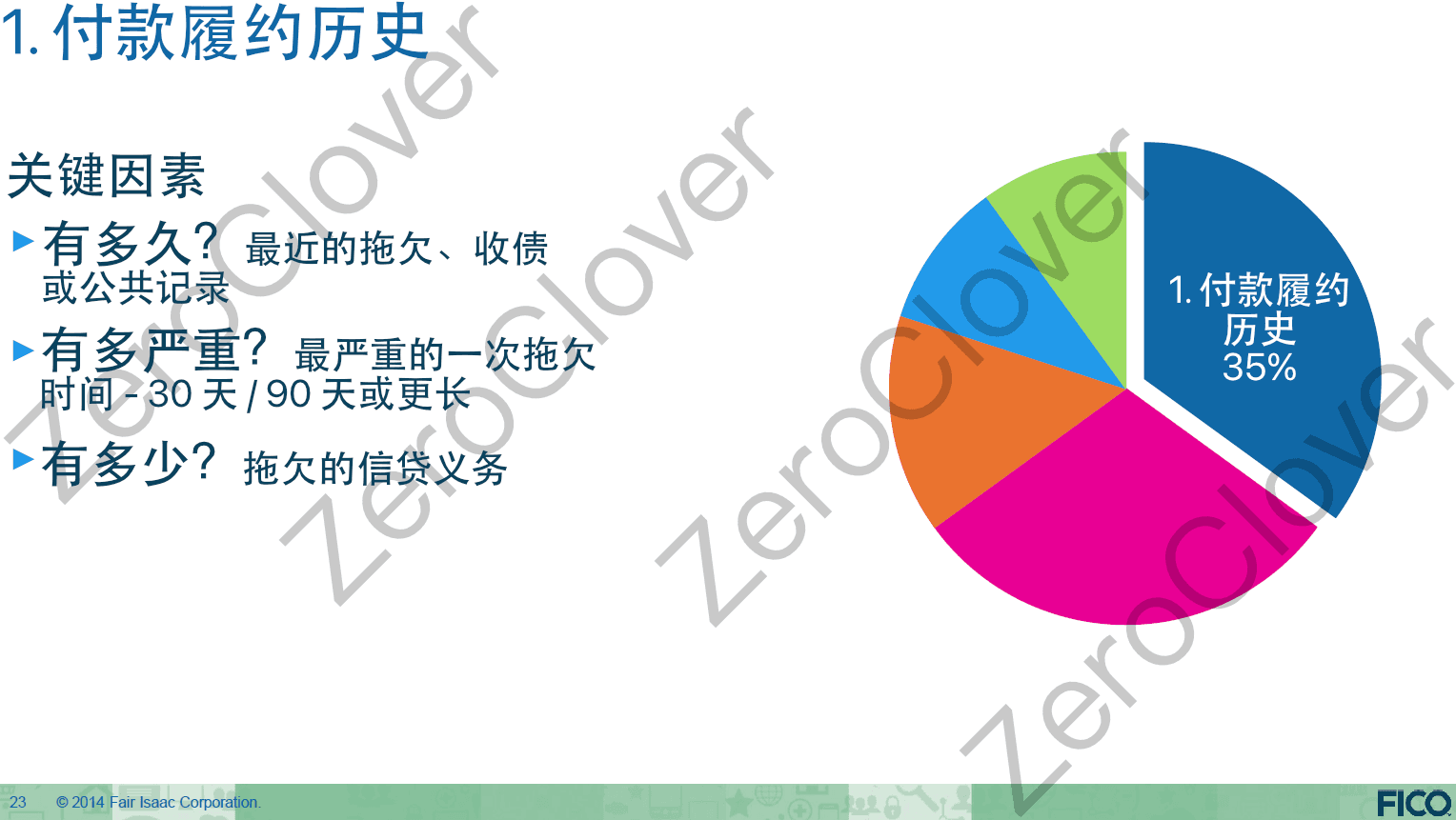

Accounts for 35%, approximately 192.5 points.

Payment history consists of 7 parts:

- Payment information for credit cards, retail accounts, installment loans, mortgages, and other types of accounts.

- Current and past late payment occurrences

- Amount still owed on delinquent or collection accounts

- Number of late items in the credit report

- Adverse public records (e.g., bankruptcy)

- Time elapsed since the occurrence of delinquency, collections, or adverse public records

- Number of accounts paid as agreed

A. Adverse Categories

This is the most important classification, and it is essential to have no negative impacts to achieve the highest score in this category. The FICO algorithm checks for delinquencies, including 30 / 60 / 90 / 120 days of delinquency, CO (Charge-off), CAs (Collections), BK (Bankruptcies), CFAs (Consumer Finance Accounts), tax liens, or LM (Loan Modification, code AC) in FICO 9. Ideally, none of the above should exist. If you have a single isolated 30-day or longer delinquency, you will suffer a severe penalty.

A 60-day delinquency will be considered a serious negative behavior and will result in you being assigned to a "dirty" scorecard for 7 years (according to MyFICO moderators' tests, a 60-day delinquency seems to only assign you to a dirty scorecard for 2 years on TU4, with EX2 / EQ5 showing similar behavior).

Creditors typically report delinquencies to credit reporting agencies at 30, 60, 90, and 120 days after the delinquency occurs, after which the delinquent account may be marked as "CO" (loans are usually considered charged off after 120 days, while credit cards are after 180 days). CO does not mean the delinquency has been settled; it simply means the creditor no longer expects to receive payment and removes it from their balance sheet. At this point, if the account is still open, the next step will be to close this account. If there are still unpaid amounts owed to the OC (Original Creditor), the TL (Tradeline, understood as your individual credit account) will reflect the unpaid balance.

Note that CO is an accounting measure and may not directly affect your score. The score loss is primarily related to TPOD (Total Period Of Delinquency), which refers to the period from DOFD (Date Of First Delinquency) to the date of the last delinquency data report (if you still have not paid all delinquent amounts), or from DOFD to the date of payment settlement (if you have fully paid the delinquent amounts). In other words, if the OC reporting CO continues to report delinquency to CRAs, your score will always be affected; if the OC does not report, it will not be affected. This is also why your FICO score may drop when you pay off the delinquent amounts after a period of CO.

B. Collections / Collection Agencies (CA)

If you still fail to repay the debt after it has been charged off, the creditor may sell it to a collection agency. If you have no other public records, this will incur an additional penalty on your FICO score, and you will be assigned to a PR scorecard.

When collection agencies contact you, they must notify you in writing within 5 days of your debt validation (DV) rights. You have 30 days to request DV from the CA, and it should be sent via CMRRR (Certified Mail Return Receipt Requested). The law prohibits them from taking further contact or collection actions until the CA responds to this. If the CA fails to respond to the DV in a timely manner or cannot provide evidence, they may delete your collection record from the CRAs. If they do not do this, you can request a dispute with the CRAs. But remember, if these debts are valid, even if you delete these records through contacting the CRAs and making false statements, they (the negative records) can always come back.

If the debt is sold to a CA, the OC TL balance should reflect as 0. The best way to handle collections is to notify the OC and request them to recall the debt so that the CA record can be removed from your credit report (but you still need to repay the debt).

However, if the OC TL is sold to the CA, you can only negotiate with the CA. You may want the CA to delete your collection record from your credit report upon receiving payment, known as PFD (Pay for Delete). But note that this violates CRAs' policies, so the CA may not accept this proposal, but they may still be willing to do it in different terms. CAs are generally reluctant to leave written records for this, but verbal commitments can still be enforceable. To avoid them denying it, you may want to use recorded calls as evidence, but you need to refer to your state's recording laws.

As for the FICO score, if a CA record appears, the only factor affecting the score is "when the collection record was reported." This means that the FICO 8 score does not consider whether you have paid the delinquent amount. This only improved with FICO 9. However, the FICO score is not the only criterion for determining whether you can obtain new credit. Settled late payments are always better for potential lenders.

C. Age of Adverse Records

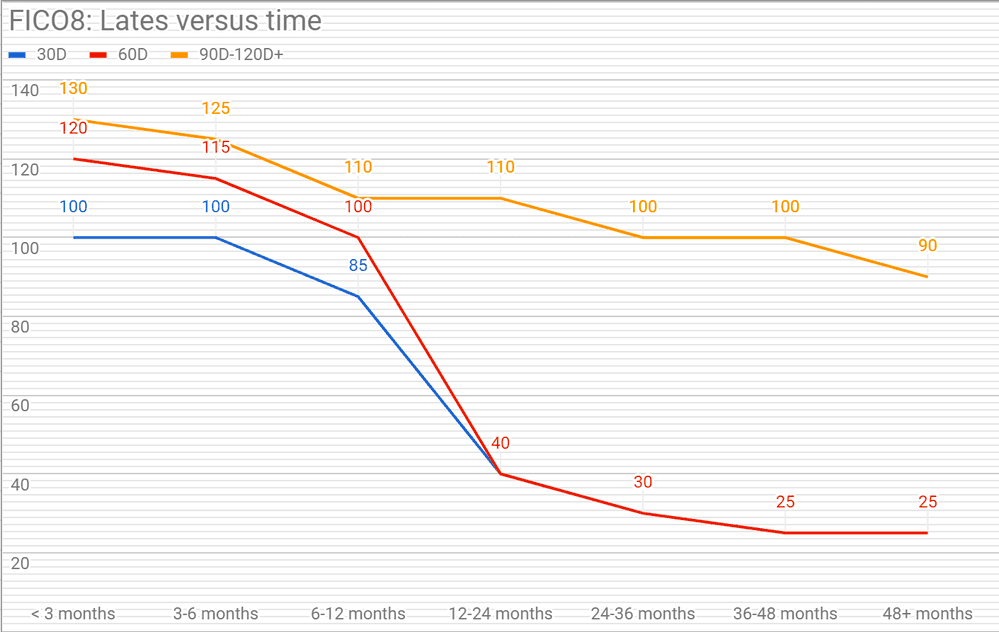

- Score Impact

It is believed that for 30, 60, 90, and 120 days of delinquency, the penalties for delinquency decrease at 6, 12, and 18 months, but all adverse records will affect scoring for 7 years. The frequency of adverse records and whether they occurred recently play a crucial role. Changes after 2 years may be due to scorecard reassignment, which may also apply to CO.

The vertical axis in the above chart shows the impact of adverse records on FICO scores, while the horizontal axis shows the time elapsed since the adverse records occurred.

CO status delinquencies are tricky; they do not remain constant like settled delinquency records, where TPOD remains unchanged at 30, 60, 90, or 120 days. For CO, if the OC regularly updates this record, TPOD will continue to increase and affect the score until paid off. If the OC fails to regularly update the OC TL, the algorithm does not know that the delinquency period has increased, so TPOD does not grow and does not lead to further score impact; however, if the OC updates the TL at a later time, the algorithm will realize that TPOD has increased and will impose additional penalties on your score. This often happens when someone pays off old delinquency records, only to be shocked by the score loss. The same applies to debts sold to CAs. However, this decline can be offset or balanced by utilization or other changes.

Three factors are particularly important: "Payment Status," "Current Status," and "Update Date." Payment status shows the highest delinquency status that has occurred on this account (30 days to CO), while "Current Status" shows CO, paid, or unpaid, and the update date has its obvious meaning.

When the OC regularly updates the update date field for CO, it continues to affect the score because TPOD is increasing, similar to the process of moving from "30 days delinquent" to "60 days delinquent." Because the current status field remains CO, the FICO algorithm knows you are still delinquent until the last update and calculates the gradually increasing TPOD (update date field - DOFD) and penalizes accordingly. If applicable, the threshold is unknown. If the update date field is not updated, the algorithm cannot determine that TPOD has increased, so it cannot further affect/punish the score. (When they do not update, be glad, but know you may ultimately pay for it).

When updates occur, the OC updates the update date field, and if the current status remains CO, TPOD will increase. As mentioned, updates usually occur when the current status field is updated to paid or a small amount has been paid, or through disputes. Once paid off, subsequent disputes should not lead to a score drop because the current status is paid, thus freezing TPOD (once CO is paid, you can request the OC to remove the delinquency record/account. This will not harm your credit record, but it may take 114514 attempts; please persist!).

CAs are entirely different; even if you pay the CA, whether partially or fully, it seems to help the score only when deleted or exceeding some unknown threshold, generally assessed based on when the collection record appears on your credit report. Typically, the newer the collection, the greater the impact on your FICO score.

Tax liens and bankruptcies also reduce penalties over time. Court judgments are no longer reported on credit records, but this can change at any time.

- Deletion of Records

According to Section 605(a) of the Fair Credit Reporting Act (FCRA) (15 USC § 1681c), this applies, but each credit bureau handles it slightly differently.

First are isolated delinquency records, which all credit bureaus will delete from credit reports 7 years after the delinquency occurs. For consecutive delinquency records, Experian will remove a string of delinquent records 7 years after the first delinquency date, while the other two credit bureaus have no officially published policy explanations; they remove based on DOFD or treat each delinquent payment record as an independent negative information item, thus not removing until each item reaches 7 years. It is worth noting that student loans or federally guaranteed loans have special reporting periods. See Sections 430A(f) and 463(c)(3) of the Higher Education Act of 1965.

Section 605(a)(3) of the Fair Credit Reporting Act states that paid tax liens will be deleted 7 years after payment; Section 605(a)(1) states that bankruptcies will be deleted 10 years after the ruling or declaration date.

- Reference for Deletion Time of Negative Information in Credit Reports

- According to §605(a)(1), bankruptcy records will be deleted within 10 years after the bankruptcy order or judgment;

- According to §605(a)(3), paid tax liens will be deleted within 7 years after payment;

- According to §605(a)(4), CO and CA will be deleted 7.5 years after DOFD or 7 years after CO/Collection; New York State is 5 years.

- According to §605(a)(5), any other negative information will be deleted within 7 years (starting date is vague).

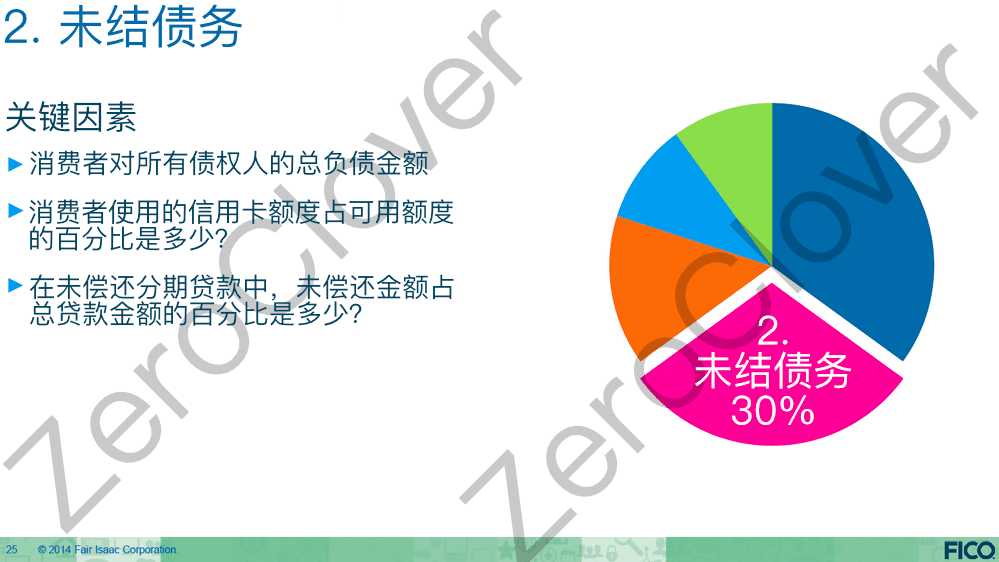

2. Amount of Debt#

Accounts for 30%, approximately 165 points.

A. Utilization

- Revolving Credit

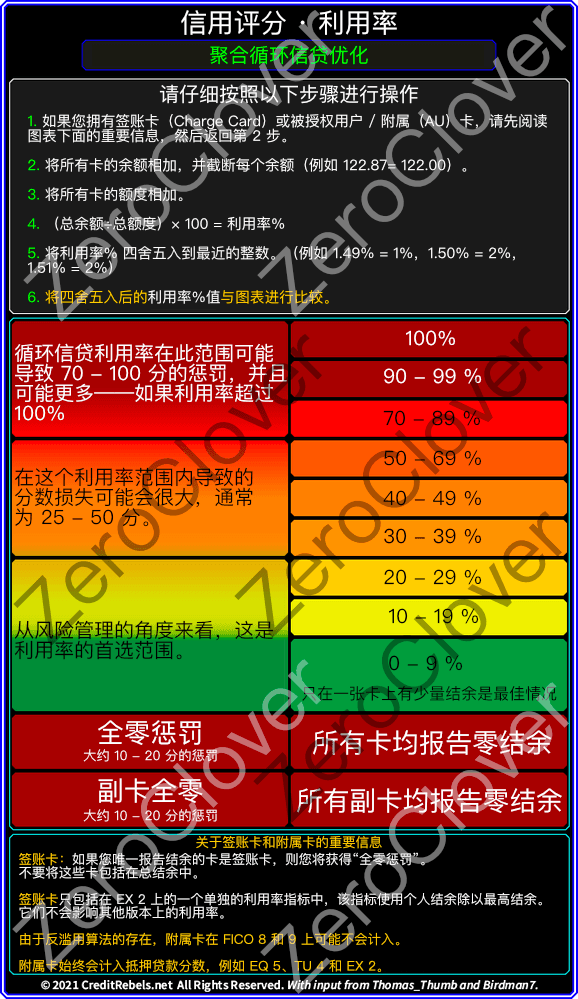

i. Recognized primary thresholds for revolving credit utilization may occur at 5%, 10%, 30%, 50%, 70%, 90%, and 100% (there may be some other scorecards with different thresholds).

ii. Recognized personal revolving credit utilization thresholds may occur at 30%, 50%, 70%, 90%, and 100% (some scorecards may also have lower thresholds). (Personal utilization is calculated from the balances in the credit report and is not always the same as the balances on bank statements.)

To achieve a high score, you should keep below the lowest threshold. As your utilization rises, penalties will be applied to the score, with aggregate thresholds affecting the score more than personal thresholds. Generally, rounding is used; for example, you should be able to maintain a utilization of 9.4% without entering the next range, i.e., "10%-29%," but 9.5% = 10%.

See the chart below for the aggregate effect of revolving credit utilization:

For the "Amount Owed" category, PLOC (Portfolio Line of Credit) should be counted as revolving credit accounts, but true charge cards should not be counted as revolving credit accounts (though they will affect credit diversity).

If HELOC (Home Equity Line of Credit) is below the cutoff amount for revolving credit accounts, it should be counted as a revolving credit account in FICO 2 / 3. However, in FICO 5 / 4, HELOCs do not seem to be considered (there are rumors of an update, but they will be considered in FICO 3). In FICO 8 / 9, HELOCs are counted separately and included as the ratio of all revolving credit account balances in TU and EX's FICO 8.

- Loans

One indicator of loan utilization is the aggregate utilization of all unpaid loans (current total balance / total original loan amount). The highest threshold (highest score reward) occurs when B/L is less than 9.5%, which can yield a score reward of about 15 - 35 points. Smaller rewards are considered at around the 65% threshold.

In simple terms, to achieve the highest reward score in this category, you need to obtain a long-term loan and then make payments to keep the aggregate utilization below 9.5%, followed by small payments to keep the loan account active. Note that this requires a financial institution that will not cause the loan to mature early, and this method does not work when you have other loans, as installment payment utilization is based on the aggregate.

While reducing aggregate loan utilization to below 9.5% can yield good rewards, there is also evidence that the duration of the loan will also provide score rewards for installment accounts.

All three agencies focus on aggregate loan utilization, while EX and TU also track separate mortgage, auto loan, and HELOC utilization, as well as special HELOC balances relative to revolving credit account balances.

B. Number of Accounts Reporting Balances

The number of accounts reporting balances independently affects your FICO score, regardless of credit utilization. The higher the utilization of a single account, the more severe the penalty on the score. However, the number of accounts reporting balances has a lower weight in the classic FICO 8 score, and its impact is even smaller on EX 8.

This metric has a greater impact on mortgage scores (especially EX2 scores), and it is believed its threshold is lower.

No matter how many revolving loan accounts you have, if only one reporting account has a balance, then your credit utilization number/percentage will reach the lowest number/percentage allowed by your profile (you cannot change the fact that the loan has a balance, so having too many loans may lead to too many accounts with balances).

This gives rise to the notorious AZEO (All Zero Except One) concept. You often hear this advice, especially when you want a better mortgage score to obtain favorable mortgage rates. This does not mean you must allow only one revolving loan account to report a balance to achieve the best score, but it ensures your profile is below the minimum possible threshold for these metrics (which may or may not be a revolving loan).

Additionally, AZEO is often recommended to use a national bank-issued credit card with a small balance, which can actually optimize three or more metrics: "number/percentage of accounts reporting balances," "revolving credit utilization," and "revolving credit balance" metrics.

Thus, this is a simple way to achieve the best score, but you may be able to have several accounts with small balances and report to CRAs while still achieving the best score. You just need to test your profile. Furthermore, this also allows you to avoid paying interest; you just need to pay before the due date but after the reporting date.

Regarding the AZEO card you will use, be cautious. Use a national bank-issued credit card with a credit limit not exceeding $31,000, as mortgage scores will exclude cards with higher credit limits. Avoid using retail cards, credit union cards, and charge cards, as they may lead to unintended consequences.

Generally speaking, the more revolving loan accounts you have, the more revolving loan accounts you can have reporting balances to CRAs while still achieving the best score. The author of this strategy recommends having at least 5 revolving loan accounts, 1 installment loan with a balance/total ratio below 9.5%, and no inquiries or new accounts in the past 12 months to achieve your best score. It is worth noting that this is a metric that is more responsive on TU and EQ. Many report no changes on EX.

While true charge cards (e.g., American Express charge cards) balances do not count towards revolving credit utilization (only counted on EX 2, using the highest reported balance as the credit limit for the account), they will still be counted in the number of accounts reporting balances in FICO 8, which is why charge cards are not recommended as part of your AZEO strategy.

C. All Zero Balance Penalty (Including Testing for Authorized Users)

When all revolving credit accounts report a 0 balance (All Zero), it may lead to a FICO score loss of 10 - 20 points. If you also have authorized users (AU) and these AUs are not excluded by FICO's abuse prevention algorithm, when these AUs report a 0 balance, it will also independently incur a penalty of 10 - 20 points on your FICO score. EQ 8 and EX 8 also seem to penalize zero balances on retail accounts.

This feature allows you to test whether your AUs are excluded by FICO 8 / 9's abuse prevention algorithm. You just need to compare the score changes when AUs report a 0 balance versus when they have a balance. Note that mortgage scores will always calculate AUs (as there was no abuse prevention algorithm at that time), but lenders may realize your score is a blown-up balloon.

To avoid the all-zero balance penalty and achieve a higher score, many people use the AZEO strategy, which has been introduced in the earlier part of this article. However, note that if you use a Chase credit card as your AZEO account, you need to avoid bringing the credit card account payment to a 0 balance at certain times. This is because Chase always reports data to CRAs more aggressively. If you bring the credit card account payment to a 0 balance, Chase will immediately report to CRAs, leading to you immediately incurring the All Zero penalty. But as long as you leave a few dollars each time, Chase will be the best AZEO card. If other cards unexpectedly report a balance, just immediately bring the Chase card payment to a 0 balance to continue maintaining AZEO.

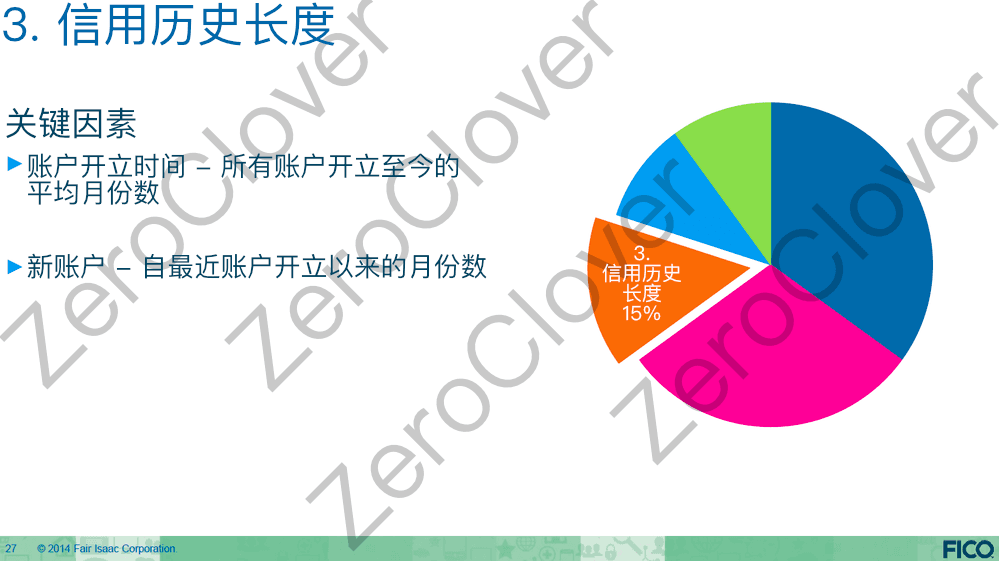

3. Length of Credit History#

Accounts for 15%, approximately 82.5 points.

Score changes related to account age occur on the first day of each month. Regardless of the day the account was opened, the FICO algorithm treats it as opened on the first day of the opening month. Therefore, to generate accurate metrics, adjust your account opening dates accordingly.

A. Age of Oldest Account (AoOA) and Average Age of Accounts (AAoA)

- The age of the oldest account is a segmentation factor for a clean profile.

AoOA is not a FICO scoring factor, but it is a scorecard assignment segmenter (segmentation factor / segment factor). An increase in AoOA may move your profile to a different scorecard, as the scoring factors' weights used by different scorecards vary, and the minimum/maximum values provided by different scoring factors are associated with the scorecard. This may lead to changes in your score.

Mature personal profiles are more stable and more welcomed by potential creditors. They incur smaller penalties but also receive fewer rewards. The mature scorecard for FICO 8 was previously thought to be 10 - 15 years, but now we find it is 3 years! TU 4 and EQ 5 segment at 2 years. Generally, being reassigned to a mature scorecard results in a 20-point loss, but this is very individual-specific as everyone's situation differs.

Each version of FICO has only one AoOA threshold (for example, we previously mentioned 3 years—for FICO 8), and AoOA is not a scoring factor, so it does not lead to an increase in your score. If you gain a score reward due to an increase in AoOA, it is likely that this reward comes from AoORA, which is a scoring factor and likely behaves similarly to your AoOA. Therefore, for most people, these metrics operate the same way. The lack of awareness regarding AoORA has delayed the determination of AoOA and AoORA thresholds.

- Average age of accounts is a scoring factor.

The rewards for this factor seem to be higher for "young" profiles, i.e., AoOA < 3 years scorecards.

The rewards for AAoA have the following characteristics:

- Calculated every 6 months

- Rewards 3 - 15 points per year

- Reaches maximum at 90 months

There are thresholds of 12 and 18 months on "young" scorecards, as well as unverified thresholds of 24 and 30 months, likely having thresholds at 60, 66, 72, 78, 84, and 90 months.

B. Age of Oldest Revolving Account (AoORA) and Average Age of Revolving Accounts (AAoRA) are scoring factors

FICO has never published specific thresholds, but after analyzing a large amount of data from the myFICO forum, we believe there are thresholds at 24 months and 30 months. Here is some information from FICO:

Since most people's first credit accounts are credit cards (revolving credit accounts), AoORA = AoOA. Therefore, when it is actually AoORA (scoring factor) that provides the benefit, it is mistakenly thought to be AoOA (segmentation factor) that provides the score reward.

Assuming two "clean" "young" personal credit profiles have similar AoOA and other statistics, but significantly different scores, why? One starts with a credit card, the other with a one-year loan. AoORA indeed differs. Which one do you think has a higher score? The one that started with a credit card.

We believe 20 years is sufficient for AoORA to maximize its benefits, while 9 years is sufficient for AAoRA to maximize its benefits.

C. Age of Oldest Installment Account (AoOIA) and Average Age of Installment Accounts (AAoIA) are scoring factors

TU 8 does not track this metric, but there are negative factor codes that reference this metric.

D. Age of Oldest Open Installment Account (AoOOIA) and Average Age of Open Installment Accounts (AAoOIA) are scoring factors

EQ 8 does not track this metric, but some negative factor code variants reference this metric.

E. Age of Oldest Mortgage Account (AoOMA) and Average Age of Mortgage Accounts (AAoMA) are scoring factors

EQ 8 does not track this metric.

F. Age of Oldest Open Mortgage Account (AoOOMA) and Average Age of Open Mortgage Accounts (AAoOMA) are scoring factors

EQ 8 does not track this metric.

G. Age of Oldest Revolving Bankcard (AoORBC) and Average Age of Revolving Bankcards (AAoRBC) are scoring factors

H. Age of Youngest Account (AoYA)

AoYA is a scoring factor for FICO 8 / 9, while it is a segmentation factor for FICO 5 / 4 / 3 / 2. AoYA = AoYRA unless the youngest account is a loan account. AoYA is a scoring factor for FICO 8 / 9, thus directly affecting the score. On the other hand, AoYRA is a segmentation factor for 8 / 9 and indirectly affects the score through scorecard reassignment. They are also different categories! Similar to AoOA and AoORA.

This metric seems to be the source of some personal credit profiles gaining score benefits in months divisible by 3, rather than AoYRA. Note that AoYA does not discriminate against loan accounts, while the AoYRA segmentation factor in the "new credit" category does.

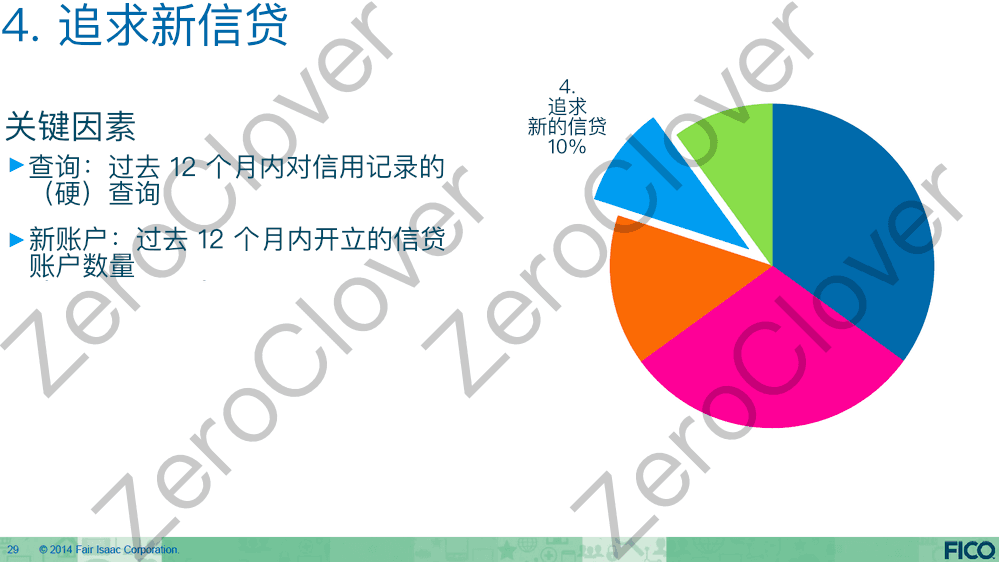

4. New Credit#

Accounts for 10%, approximately 55 points.

A. Age of Youngest Revolving Account (AoYRA) is a segmentation factor in FICO 8 / 9 "clean" profiles.

For FICO 8, if you have not opened any new revolving credit accounts or open-ended accounts (OE) in the past 12 months, you will be assigned to the "no new revolving credit" scorecard. If you have at least one new revolving credit account opened within the last 12 months, you will enter the "new revolving credit" scorecard. With all other factors being equal, there is usually about a 10 - 15 point difference.

This is one reason why new revolving accounts reporting can lead to score drops. If you already have an account younger than 12 months, you will only see changes related to AAoA, AAoRA, and utilization when it reports; however, if your new revolving credit account age is between 0 - 12 months, it will lead to scorecard reassignment, which will bring potential changes and significant penalties for initial hard inquiries, which will be discussed shortly.

Loans are not included in AoYRA. The AoYA metric includes loans and is a scoring factor for FICO 8 / 9, but it is also part of the length of history factors.

For FICO 5 / 4 / 3 / 2, AoYA segments profiles into "new accounts" or "no new accounts" scorecards, functioning similarly to AoYRA for FICO 8 / 9 mortgage scoring.

B. (Hard) Inquiries

There are many terms and slang related to inquiries: INQ, credit requests, credit pulls, hard inquiries, hard pulls (HP), and soft inquiries, soft pulls (SP). For this explanation, inquiries refer to HP—i.e., the process of hard pulling or hard querying your credit report.

In simple terms, when a lending institution requests to view your credit record, they will record this inquiry on your credit report. Most often, inquiries occur when you apply for personal loans, credit cards, or mortgages, but they can also happen due to leasing or employment.

Inquiries are divided into two main categories: those that affect your credit score and those that do not. For this article, we only consider those inquiry events that will impact your credit score—i.e., hard inquiries or hard pulls (HP).

Hard inquiries or hard pulls become formal records and will remain on your credit report for 25 months. Hard inquiries will affect your credit report and may also impact your credit score. They occur when you apply for loans, mortgages, credit cards, and, in some cases, request a credit limit increase. Employment records and lease agreements may be hard inquiries or may not be.

Soft inquiries or soft pulls are less formal and less significant reviews of your credit report. Soft inquiries do not affect your score and do not impact your credit report. An example of a soft inquiry is checking your own credit record. In some cases, issuers (credit cards or revolving credit) can code credit limit increase requests as SP. Soft inquiries are only visible to you; lenders cannot see how many or which soft inquiries are on your credit report.

Lenders determine whether an inquiry is coded as HP or SP; CRAs merely record them and cannot decide how to code them.

Here are some quick facts about hard inquiries:

- They remain on your credit report for 25 months (but each credit bureau's policy may vary slightly in this regard).

- For revolving credit inquiries, each HP is immediately recorded on your credit report.

- For the same installment or mortgage, multiple HPs should be recorded as a single inquiry, usually within 30 - 45 days after the initial HP.

- HPs may affect your credit score.

- Generally, HPs do not impact your credit score after 12 months, as the score lost due to HPs may recover.

- The impact of HPs on credit scores depends on the specific credit report (refer to later sections).

- Different FICO scoring models have varying sensitivities to HPs.

- Some potential lenders are more sensitive to HPs, and they may refuse to approve your new credit due to "too many" HPs.

- If your score changes after applying for and opening new credit card accounts, that score change may partly stem from HPs. Opening new accounts may change your score. These two events (HP and new accounts) are different but related. Your score change may be caused by the new account alone or by a combination of HP and the new account.

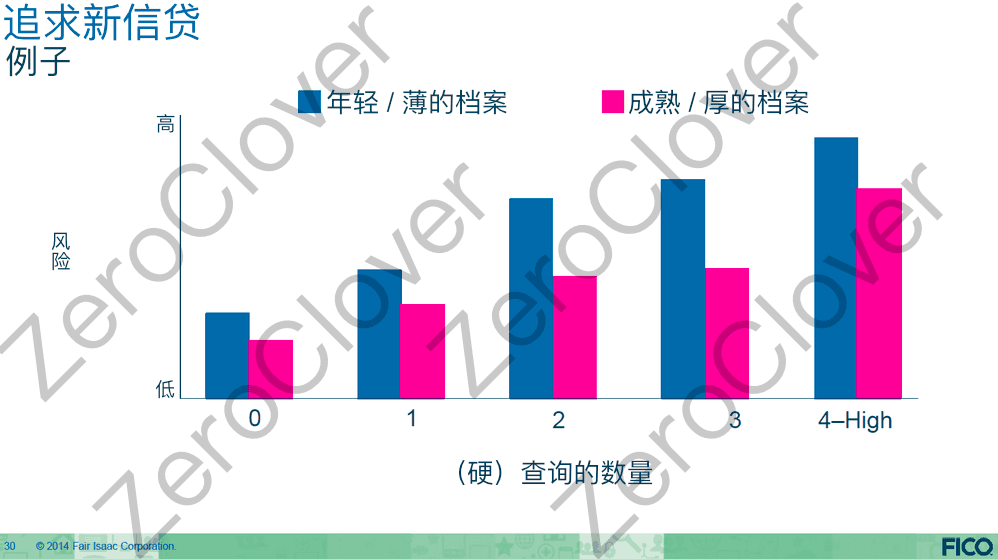

Each hard inquiry may lead to a FICO score loss of 0 - 20 points, but the impact on "mature"/"thick" credit profiles is < 5 points, while the impact on "young"/"thin" profiles is higher.

The 9th or 10th (hard) inquiry is a threshold; even if the number of inquiries increases further, there is no additional penalty on the score.

Hard inquiries are also considered segmented. For example, the first hard inquiry within 12 months will penalize the score, but the second will not; the third hard inquiry will again penalize the score, but the fourth will not. The specific segmentation strategy is not clear and may relate to scorecard assignments.

Hard inquiries will remain on credit reports for 25 months but only impact credit scores during the initial 12 months.

The purpose of hard inquiries is to inform other potential lenders of your attempts to seek new credit, helping to limit your pace, slow your actions, and protect lenders' interests, preventing you from seeking too much new credit in a short time, or at least keeping other lenders alert when lending to you. Therefore, feel happy when you receive an SP CLI (Credit Limit Increase).

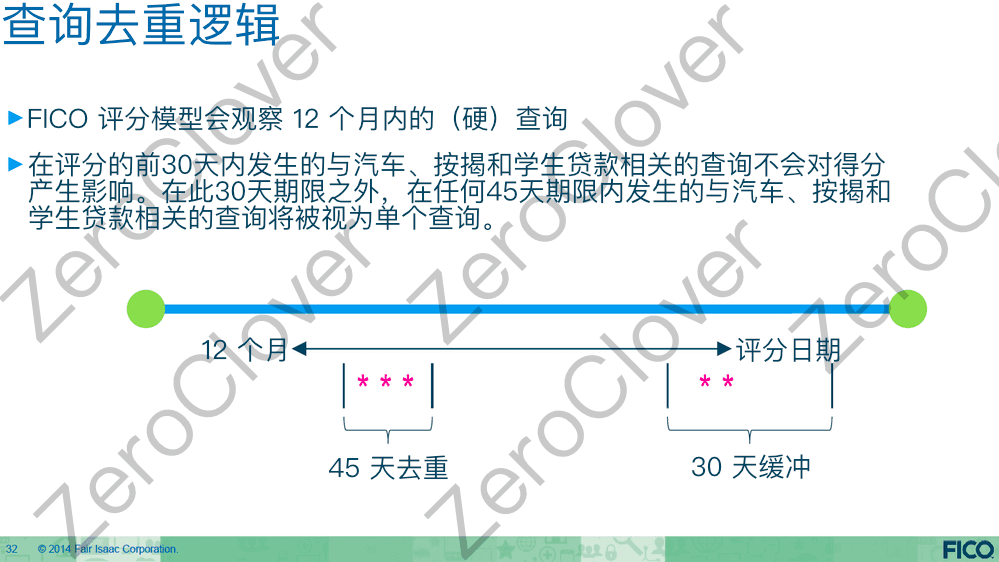

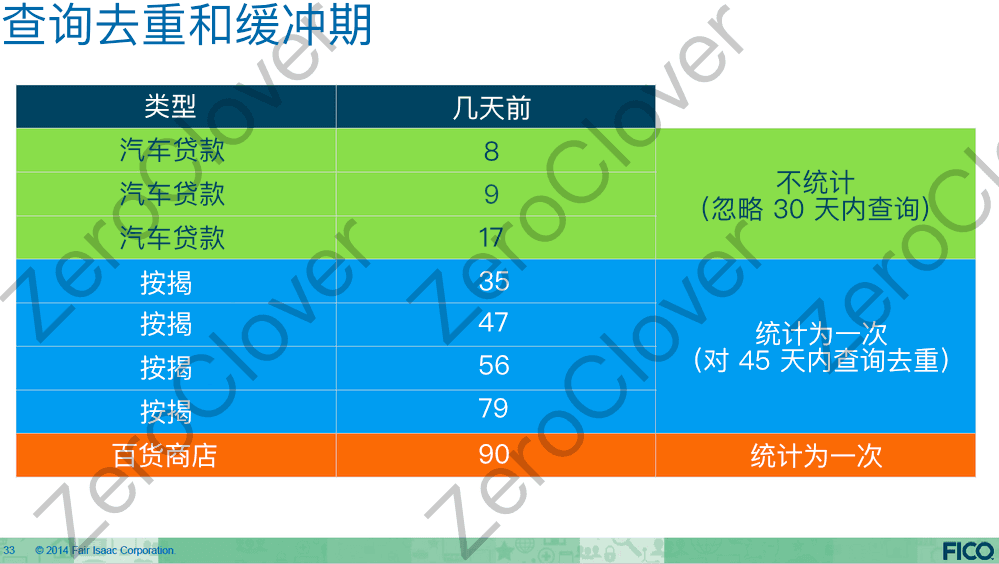

Buffering / Deduplication of Inquiries Caused by Installment Loans

For most hard inquiries, the impact on the score is immediate, but the FICO 8 model ignores hard inquiries made within 30 days for the same installment loan (if they are correctly coded).

Hard inquiries for the same type of installment loan within a 45-day window count as one. The algorithm is designed to allow rate shopping. Deduplication does not merge different types of installment inquiries. Mortgage (mortgage) inquiries and auto loan inquiries will not be deduplicated. However, from a scoring perspective, making 10 auto loan inquiries within 45 days will only penalize you as if it were one inquiry.

Note that when applying for a credit card, most lenders' computer systems will only see the raw number of (hard) inquiries without deduplication, which may lead to lenders sensitive to the number of hard inquiries rejecting your application. The solution is not to apply for credit with lenders that do not allow "reconsideration" (Reconsideration, often abbreviated as recon) (looking at you, Capital One). If you are automatically denied by lenders for the reasons mentioned above, call the lender's approval department and explain that multiple inquiries were for rate shopping for the same loan; you will usually get approved.

Soft inquiries are conducted for various reasons and do not affect credit scores; they can only be disclosed to consumers. For example: promotions, AR (Account Review), consumer disclosure, insurance, employment, etc. The type of SP determines the data provided.

For example, promotional inquiries do not provide account information, only contact data. AR provides everything except SP, while consumer disclosure provides everything.

C. Is the "Too Many Recently Opened Accounts" Denial Reason Code Serious?

This is a scoring factor that considers how many revolving credit accounts have an age of less than 12 months in the past 12 months. It may be similar to inquiries—just having one in the past 12 months is too many, depending on the lender.

Opening too many new accounts within 30, 60, or 90 days after opening an account may lead to additional "crazy spending" penalties. This penalty is believed to stop after 12 months, but all details are unclear. This may not affect mature credit profiles.

Note: When a new revolving credit account reports, if no accounts were opened within 12 months prior, a "new revolving credit account penalty score" will occur, leading to scorecard reassignment (AAoA, AAoRA, AoORA, and utilization changes (if applicable) and other factors will all be considered at once during scorecard reassignment). If other accounts are reported subsequently, but there is still one account opened within 12 months, it may cause impacts on AAoA, AAoRA, and utilization changes, which will also occur in the previous case, but since the algorithm considered them in the previous instance, it is impossible to determine how much each factor contributes to the change. However, if no thresholds or usage limits are crossed, it becomes easier to make informed guesses.

Obtaining another credit card within 12 months may not incur the penalty of newly opened credit cards, but it will extend the time you are under this penalty. Therefore, I recommend obtaining the credit card you need every 12 months before the first credit card reports, as now you have a 12-month penalty, and extending this time is of no use. Additionally, it is best to have the best score when applying for a credit card, so waiting 12 months can allow you to achieve the best rewards, and it can also allow your HP and new credit card accounts to age, resetting potential crazy spending penalties.

5. Credit Mix#

Accounts for 10%, approximately 55 points.